sager electronics | Ultimate Power Electronics and Electrical Protection Bundle

$70.99 Original price was: $70.99.$7.99Current price is: $7.99.

samsung electronics america | Electronics in Biomedical Engineering: Theory & Repair

$94.99 Original price was: $94.99.$9.99Current price is: $9.99.

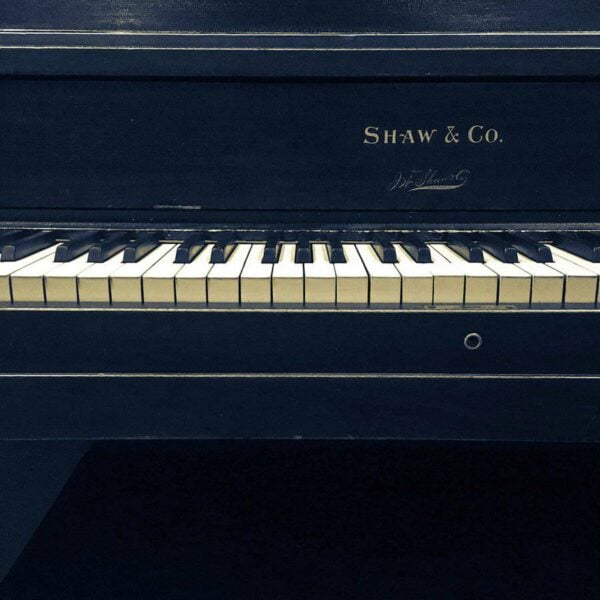

electronic high school | Music Theory for Electronic Producers – The Complete Course!

$99.99

Join Successful students in Music Theory for Electronic Producers for Creating, Arranging, and Analysing Music Theory

Category: Electronics

Tags: Best Sellers - Books - March 3, Music Theory for Electronic Producers - The Complete Course!

Description

Reviews (0)

Be the first to review “electronic high school | Music Theory for Electronic Producers – The Complete Course!” Cancel reply

You must be logged in to post a review.

Login with your Social ID

Questions

The questions is empty.

Shipping & Delivery

Related products

consumer electronic show | Consumer Behavior

$89.99

Understanding the process consumers go through before they make a purchase Our Picks from Other Merchants(CJ) Ecampus.com Consumer Behavior, Organizational Development, and Electronic Commerce $39.40 BUY NOW from Ecampus.com Biggerbooks.com Consumer Behavior, Organizational Development, and Electronic Commerce $40.58 BUY NOW from Biggerbooks.com Ecampus.com Consumer Behavior, Organizational Development, and Electronic Commerce $91.98 BUY NOW from Ecampus.com […]

electron transport chain | Logistics Management: International Transport & Shipping

electronic cards | Set Up an Electronics Home Lab Tools and Equipment

The ultimate Lenormand cards course that will help you to provide precise future predictions for you and your clients. Our Picks from Other Merchants(CJ) Zappos.com Zappos Gift Cards Gift Card - Holiday Pop Up (250) Gift Cards Gifts $250.00 BUY NOW from Zappos.com Bjs.com Go Cards $50 GO Eat Gift Card, 5.5" x 3.75" x […]

electronic classroom of tomorrow | Music Theory for Electronic Producers – The Complete Course!

electronic voice phenomenon | Music Theory for Electronic Producers – The Complete Course!

How To Record Professional Presentations and Voice-Over Recordings at Home. Improve Your Video Audio or Voice Recordings Our Picks from Other Merchants(CJ) Biggerbooks.com Electronic Voice Phenomenon Record $12.01 BUY NOW from Biggerbooks.com Ecampus.com Electronic Voice Phenomenon Record $12.26 BUY NOW from Ecampus.com - 30% Zappos.com Theory Bron D Cosmos Polo (Heron) Men's Clothing $66.36 $95.00 […]

electronic waste | Zero Waste Living 101 [Self-Paced Online Course]

$11.99

Guide to your Sustainable Learning Our Picks from Other Merchants(CJ) Staples.co.uk Metallic Black Waste Bin 14 L £1.97 BUY NOW from Staples.co.uk Staples.co.uk Osco Metal Waste Bin, 18.3 L, Black £3.47 BUY NOW from Staples.co.uk Staples.co.uk Metal Waste Bin Grey £8.39 BUY NOW from Staples.co.uk Staples.co.uk Grey Waste Bin 14 L £2.00 BUY NOW from […]

tablet phones | Cocos2d-x v3 JavaScript – Game Development Series

Cocos2d-x 3.0 Our Picks from Other Merchants(CJ) Knetbooks.com Cocos2d-x by Example $44.55 BUY NOW from Knetbooks.com Biggerbooks.com Cocos2d-x 3.0 $9.74 BUY NOW from Biggerbooks.com Ecampus.com Cocos2d-x 3.0 $8.99 BUY NOW from Ecampus.com Ecampus.com Cocos2d-x by Example $44.77 BUY NOW from Ecampus.com

Toshiba | Técnico em Manutenção de notebook – Básico ao Profissional

$30.99

Diversos defeitos catalogados para você aproveitar! Sai na frente e descubra se o defeito que você procura está aqui! Our Picks from Other Merchants(CJ) Myworld.com Manutenção em fornos utilizando confiabilidade centrada na manutenção €23.90 BUY NOW from Myworld.com Myworld.com Manutenção Centrada em Confiabilidade aplicada em Veículos €23.90 BUY NOW from Myworld.com - 25% Dosfarma.com Em-eukal […]

Hot Deals

Hot Deals Shopfinish

Shopfinish Shop

Shop Appliances

Appliances Babies & Kids

Babies & Kids Best Selling

Best Selling Books

Books Consumer Electronics

Consumer Electronics Furniture

Furniture Home & Kitchen

Home & Kitchen Jewelry

Jewelry Luxury & Beauty

Luxury & Beauty Shoes

Shoes Training & Certifications

Training & Certifications Wears & Clothings

Wears & Clothings

Reviews

There are no reviews yet.