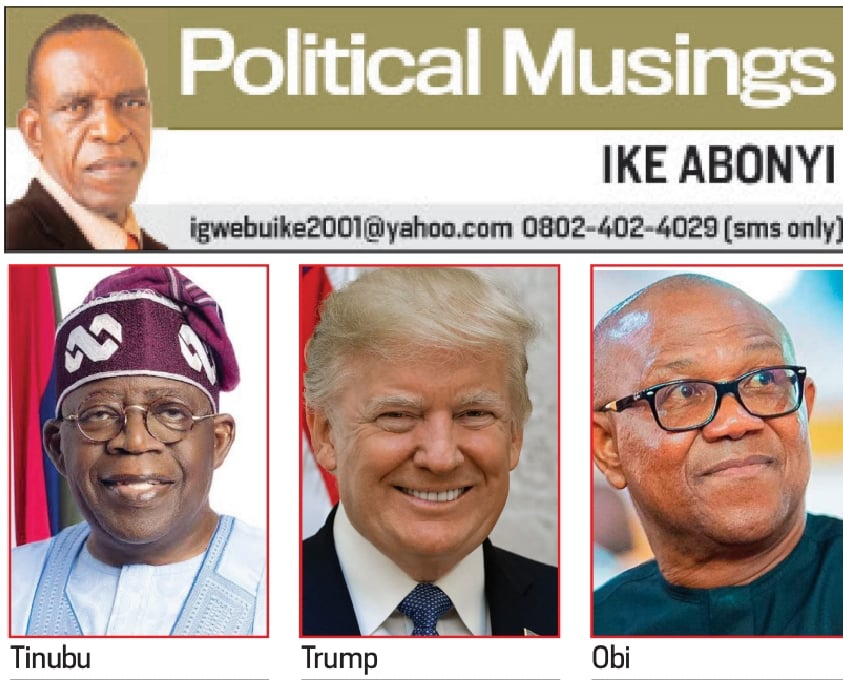

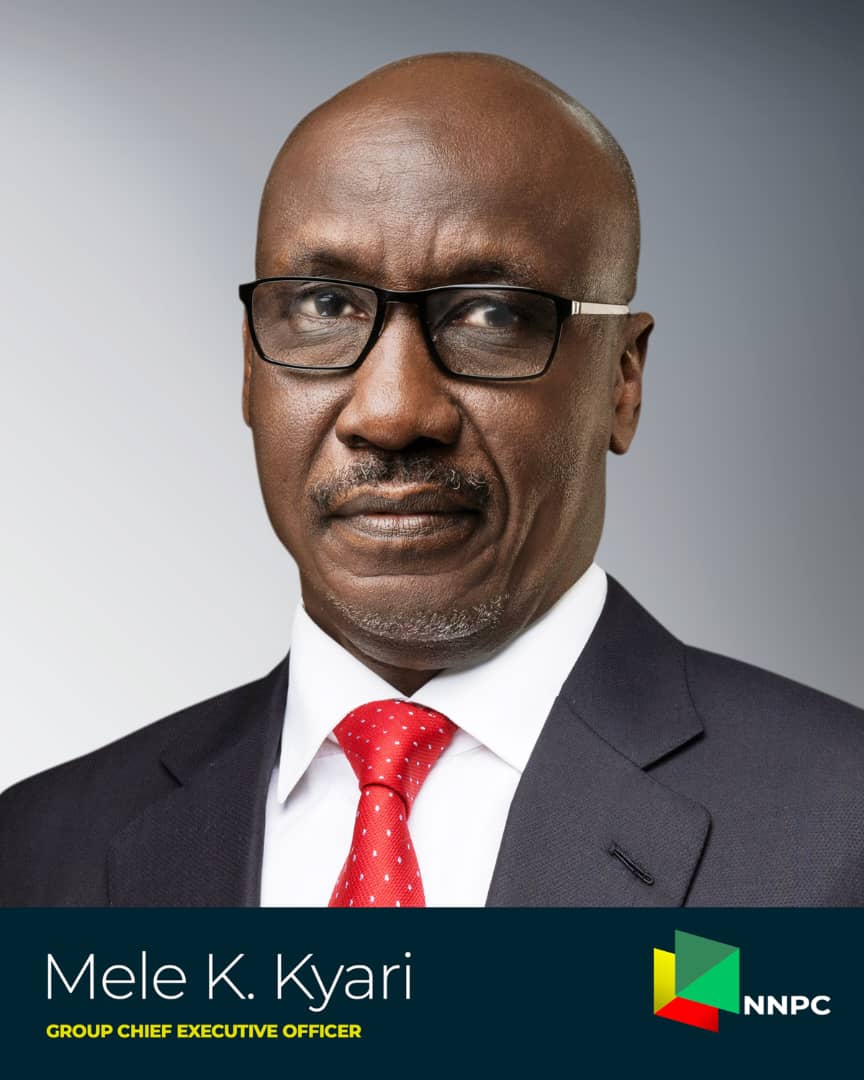

We are dedicated to ship gasoline into domestic market says NNPCL GCEO, Kyari

Politics tamfitronics

The Neighborhood Chief Government Officer of the Nigerian National Petroleum Company Ltd, Mallam Mele Kyari became once at the lawful concluded 2024 edition of CERAWeek by S&P World in Houston, United States , with the theme, ‘Multidimensional Energy Transition: Markets, local climate, expertise and geopolitics,’. He spoke on the theme of the convention , the ongoing transformation at the nationwide oil firm and extreme disorders around vitality affordability, availability and safety amongst others, EXCERPTS

The theme of this convention is the multi-dimensional vitality transition. How does NNPC gaze the disorders and questions around vitality transition for Africa and Nigeria?

It’s a truly demanding scenario for Sub-Saharan African countries. In some countries, many setting up countries, and largely in Sub Saharan Africa, we’re truly coping with vitality availability and now now not transmission. Energy availability clearly speeds to vitality safety. Right here’s extremely traditional, and we now ranking viewed it within the final challenges which ranking been thrown up by fresh geopolitical events and disorders around vitality transition. It is obvious that the nation’s most stable safety of provide to the nation. And you’ll want to perchance perchance well talk about vitality safety when it’s now now not even on hand. Shall we embrace, in most of our nation, about 70 per cent of the inhabitants don’t ranking win entry to to exquisite cooking oil, about 50 per cent don’t ranking win entry to to electricity.

So, it’s clearly a gap that you just’d like to ranking. And what’s the supreme methodology of doing it? Traditional is every person assuming that what or now now not it is miles foremost to obtain is to duvet that with renewables, nonetheless you’ll want to perchance perchance well presumably like to ranking the funds for the renewables. So, where’s it going to come? From a helpful resource dependent nation take care of our nation. Even as you advise you’re going for entire substitution this day, then you positively is doubtless to be truly sacrificing the probability of the different renewable platform that may perchance be required.

Subsequently, for us, the transition ought to be differentiated. It is a must to address the challenges of this day. Sadly, that is what it is. But you’ll want to perchance perchance well presumably like to address the issues of provide this day within the sense that there’s absolute scarcity of vitality in many African countries. So, we’re coping with them, and we’re very conscious of the truth that our business creates many impacts on the ambiance. Absolute confidence, no person’s disputing this. You’re now now not doing a accumulate off. In any other case, ought to you advise, search, switch off the final of Africa’s contribution to emissions, doubtlessly you is doubtless to be going to vary up 3 per cent and it received’t fabricate any distinction even ought to you switch it off.

We designate that there’s rarely a contest around, nonetheless in fact that you just all must enhance countries in Sub Saharan Africa in particular to shut that vitality availability gap.

Dangle us through a pair of of the transformation that has been going on at the NNPCL?

The NNPCL is clearly the supreme oil and gasoline firm in Africa and likewise the supreme company entity in Africa. It is very extreme to Nigeria’s helpful resource administration. Every little thing that we obtain in our nation has rather a lot of connection with the NNPCL

So, within the past, this firm became once a firm clearly owned by authorities and it is miles also a nationwide firm, it does many things which can perchance perchance well be conventional of many past nationwide oil corporations and we now must circulation a ways from that scenario. We now ranking reformed the course of that took us to where we’re this day and transformed it correct into a entirely restricted liability firm which methodology it’s answerable to shareholders. Currently, the shareholders are largely the final inhabitants of the nation, which is amazingly understandable, and we now ranking started the scenario where we can ranking diversified other folks earning hobby on this on this firm. By this, what we did became once to create a firm that must pay taxes, pay royalties, and likewise, at the tip, is able to present dividends to the shareholder.

The oil and gasoline exchange in Nigeria has matured to an extent that we can advise any firm working, now now not lawful us, can truly rupture even on to the subsequent assist stage.

What’s truly going on this day is that we now ranking a nationwide oil firm, which is industrial which has improved from a loss-making firm usually to now a income-making firm that is able to now now not lawful provide dividends to shareholders, create designate to its stakeholders, and its companions, a pair of of them are worldwide corporations, some local corporations in a manner that advantages all nonetheless in a roundabout plot, fully responsible, a firm that can truly migrate in a roundabout plot to a quoted firm.

So, does this imply that the authorities will quit its like shares when the NNPCL becomes a quoted firm?

It’s clearly within the contemporary legislation setting up the firm. What came about became once that there became once a reform course of backed by legislation, it’s known as the Petroleum Industry Act. and what that did is to present a pathway to getting this firm quored. So, it does create that probability by no methodology existed within the past, and therefore, in a roundabout plot, at maturity, this firm would be owned by shareholders

Is there a date when the NNPCL would be quoted?

The legislation anticipates within three years of incorporation of the firm, we can open the course of real and therefore, we’re within search.

Undoubtedly one of many issues that the NNPCL has suffered from is the outrageous oil theft within the Niger-Delta. How is NNPCL addressing that?

Clearly, oil theft is now now not basically a local project. It does occur in very many jurisdictions, nonetheless presumably in this day’s context, we gaze it in our nation. The NNPCL is working on it, and it is preventing oil theft in our nation. Sure, it’s up long-established, nonetheless it’s neatly within administration. We’re ready to enhance most of our production and constructing back confidence so that investor can place their money into the business and, for lag our advocacy is continually that you just’ll want to perchance perchance well’t rob oil and taken to the market. This market is a truly world market, and it makes very gigantic business sense after we gaze it from that context. The methodology you gaze blood diamond is the a similar methodology you almost gaze it because oil that comes from someplace usually ends within the refinery. We all know where oil is coming from and those transactions, you understand, circulation through banks, regulatory institutions, and therefore whereas all of us know and designate that it’s a local enviornment, nonetheless clearly, it’s a world ache.

What we’re doing this day lawful to present an instance in context. In 2022, production fell under a million barrels. Currently, we now ranking come again to 1.6 million barrels per day. We truly reached as much as 1.7 million barrels per day. Which methodology recovery of over 700,000 per day.

So, where’s the purpose of hobby of your funding now? Is it within the upstream gasoline, or oil sector?

Currently, our point of curiosity is constructing our ability to ship gasoline into the domestic market. Sure, we designate you all want gasoline, and we also gaze the lag connection between vitality availability, sufficiency, and construction of gasoline in any nation that is gasoline affluent nation. We’re truly a gasoline nation with associated oil, any other folks don’t realise this, we now ranking extra gasoline than oil identical and which methodology our point of curiosity to gaze how can we employ gasoline to present the different gasoline that we want. We designate the ongoing conversations around vitality transition, nonetheless what we’re seeking to form out is the scenario of vitality availability and the least pricey route to that in our context is to invent gasoline into the domestic market and provide a alternative gasoline sooner than you truly distress about one thing else. Sure, our point of curiosity is on gasoline for the domestic market. So, our point of curiosity is constructing the gasoline, setting up the resources,

Does this imply this has been a lengthy objective to harness the gasoline and win it into the market?

Sure, entirely because we gaze a lag opportunity that gasoline created this day, which wasn’t there 10 years ago.

Are you constructing the pipelines and networks now for the gasoline?

Currently, we had been constructing a different of trunk traces that can provide gasoline within our network. And, for lag, it’s very belief as NNPC is utilizing us ahead on this scenario. And constructing the infrastructure methodology that contributors will upscale and can truly now manufacture the gasoline, or place into our network and this synergy is working and, presumably at some stage within the subsequent three, four years, there will be clearly in nation, gasoline infrastructure.

What is the size of investments that is doubtless to be required for these gasoline infrastructure projects?

What we gaze is that we can doubtlessly want between $10bn to $15bn in two to three years. That may perchance well perchance well serene duvet the instantaneous gap. And for lag, looking out beyond providing gasoline within the domestic market, which is to gaze how relationships and partnerships can create gasoline for export.

And for lag, ought to you search at that, after which doubtlessly for one other incremental $10bn to $12bn and setting up the chance for growth.

Invent you assume there are contemporary opportunities for Nigeria in phrases of the LNG world gasoline market?

There may perchance be an ongoing engagement, and it is at a truly evolved stage to create a pipeline that can circulation through 13 African countries into Morocco after which soar into Europe. What that can obtain is to create integration amongst the African countries, a different of countries that obtain now now not ranking gasoline resources so that that collaboration will allow them ranking win entry to to those pipelines, and our estimate is to gaze a $25bn project. The alternate route is to circulation throughout the centre of our nation the final methodology throughout the Sahara into Algeria into Europe and that’s amazingly lag, it is vivid, we obtain now now not ranking disorders around availability of the gasoline resources since it is there and naturally we also designate that presumably a exiguous little bit of slower nonetheless no doubt extra rate efficient course of of transporting gasoline across the plot.

Enjoy these projects fully started, or are they lawful at the planning phases?

The Nigeria-Morocco gasoline pipeline is beyond planning. We hope to gaze FID by the tip of the 365 days.

Invent you gaze opportunities to enlarge Nigeria’s characteristic in LNG with the US and with Qatar and diversified traits. Are those opportunities serene there?

Clearly, yes. Currently, we had been constructing Educate 7, and this may perchance doubtless double our fresh ability within the NLNG . Moreover, we’re working on two diversified projects. One is the mounted LNG project and we now ranking reached an evolved stage of commitment so that we can bring back one other 10 million tonnes facility within the nation, and several diversified floating LNG projects nonetheless clearly, we now ranking a line of search around after all three to 4 LNG projects, We are also taking part our associate to gaze how we can add one other prepare on the LNG making it eight. We gaze gigantic opportunities.