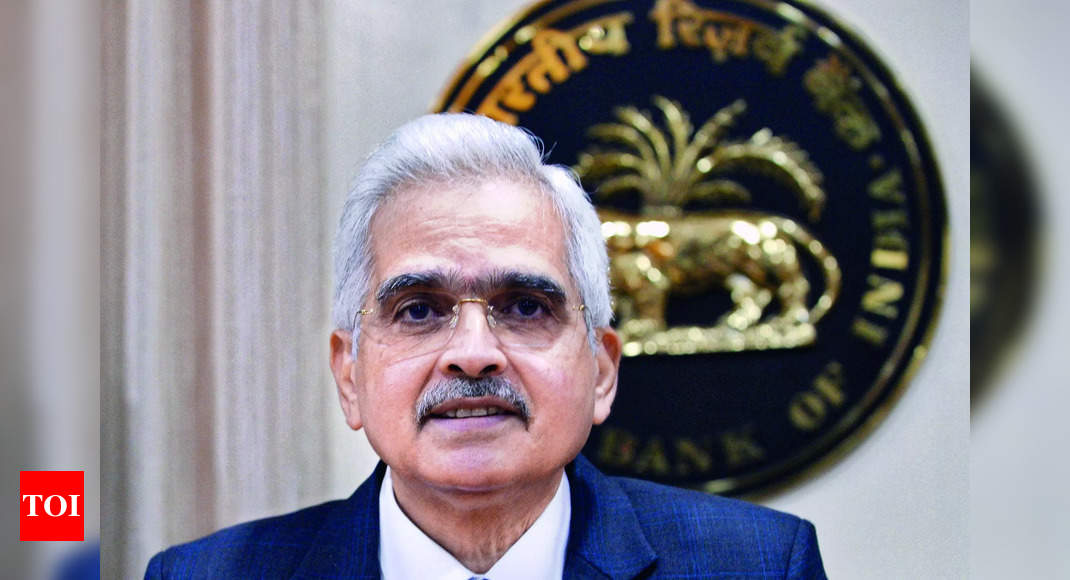

Digital rupee to procure enhance from offline characteristic: RBI governor Shaktikanta Das

Business new tamfitronics

Mumbai: RBI governor

Shaktikanta Das

talked about offline accessibility, which is in the works, will create the

digital rupee

a honest searching different for retail customers.

As well to, wholesale exercise of

CBDC

for alternate in business paper and certificates of deposit in the debt market can even be prolonged by RBI, Das talked about in a panel discussion on central financial institution digital currencies at a BIS summit.

Das talked about that CBDCs have the identical advantages as money – anonymity and finality of settlement.

On anonymity, Das talked about it’s going to also very properly be done both thru guidelines or by completely deleting transaction info. He illustrious efforts to enable offline efficiency, incorporate programmability for financial inclusion, and make stronger technology scalability for broader adoption.

While there could be currently a preference for UPI among retail customers, Das modified into as soon as hopeful that offline and programmable CBDC will switch this going forward.

Hot Deals

Hot Deals Shopfinish

Shopfinish Shop

Shop Appliances

Appliances Babies & Kids

Babies & Kids Best Selling

Best Selling Books

Books Consumer Electronics

Consumer Electronics Furniture

Furniture Home & Kitchen

Home & Kitchen Jewelry

Jewelry Luxury & Beauty

Luxury & Beauty Shoes

Shoes Training & Certifications

Training & Certifications Wears & Clothings

Wears & Clothings