India Inc raises record $30 billion in 6 months, riding FPO wave

Business new tamfitronics

MUMBAI: Indian companies raised a

record

$29.5 billion (nearly Rs 2.5 lakh crore) in the

equity market

through IPOs & FPOs during the first half of 2024, more than double the amount raised in the same period last year. The Jan-June total is the highest-ever in terms of

proceeds

with the number of issuances also rising 64%.

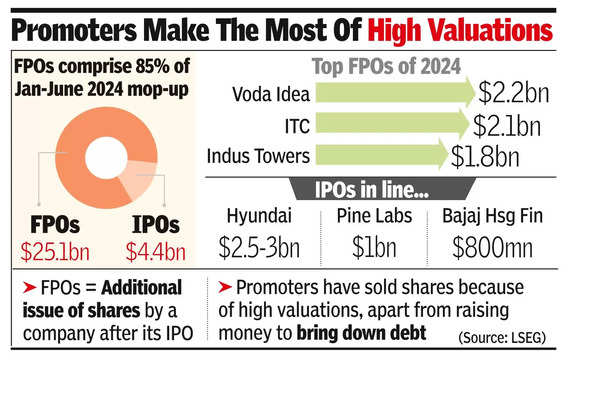

The surge has been driven by follow-on public offers (FPOs) this year – making up 85% of the total proceeds this year, LSEG’s India Investment Banking Review said.

In the first half of 2024, Indian IPOs raised $4.4 billion – a 98% increase compared to the year-ago period. The number of IPOs also saw a 71% jump year-on-year. India accounted for 27% of global IPOs by volume, up from 13% in the same period last year.

Follow-on offerings raised $25.1 billion, a 156% increase from a year ago. The number of follow-on offerings grew by 56% over the same period last year. An

FPO

refers to an additional issuance of a company’s shares after its

IPO

.

Despite the flood of new shares, demand has continued to outstrip supply as investors rushed in to buy more equity after the general election results were announced, pushing Nifty up by 10% in the first half of the year.

According to analysts, 2024 might well be a record year for equity issuances if Hyundai India proceeds with its proposed $2.5-3 billion (nearly between Rs 21,000-25,000 crore) IPO – which will be India’s biggest ever. Other large IPOs expected by the market include a Rs 8,300-crore offer from Pine Labs, a Rs 7,000-crore issue by Bajaj Housing Finance and a possible listing of HDB Finance.

The significant inflow of funds into capital markets is anticipated to make available more shares to meet demand. In the first half, promoters of 37 listed companies, including multinational corporations, offloaded their shares to both domestic and offshore investors. There have been suggestions that govt should also divest its holdings in public sector companies to capitalise on current valuations.

Vodafone Idea was the top equity issuer in the first half, raising $2.2 billion (about Rs 18,000 crore) in April – it was also the biggest FPO in India ever. ITC and Indus Towers followed with their $2.1 billion and $1.8 billion FPOs, respectively (see graphic). Other issues included TCS, IndiGo and Mphasis. Industrials, telecom and financials were the top three sectors among the issuers with 21%, 16.6% and 14.5% share of the issuance, respectively.

According to LSEG, despite increased equity markets activity, investment banking fees were down 11% at $0.5 billion, with Kotak Bank being the top earner and Citi being the top book runner.

On the M&A front, India-related M&A deals were up 4.4% in the first half at $37.3 billion. The biggest transactions were Star India’s acquisition by Viacom18 Media, ATC Telecom’s purchase by Data Infrastructure Trust and Nidar Infra – parent of data center provider Yotta by Cartica Acquisition group.

Discover more from Tamfis Nigeria Lmited

Subscribe to get the latest posts sent to your email.

Hot Deals

Hot Deals Shopfinish

Shopfinish Shop

Shop Appliances

Appliances Babies & Kids

Babies & Kids Best Selling

Best Selling Books

Books Consumer Electronics

Consumer Electronics Furniture

Furniture Home & Kitchen

Home & Kitchen Jewelry

Jewelry Luxury & Beauty

Luxury & Beauty Shoes

Shoes Training & Certifications

Training & Certifications Wears & Clothings

Wears & Clothings