Omdia: MediaTek outgrowing Qualcomm Snapdragon in the 5G smartphone market, Business News

Business new tamfitronics

![]()

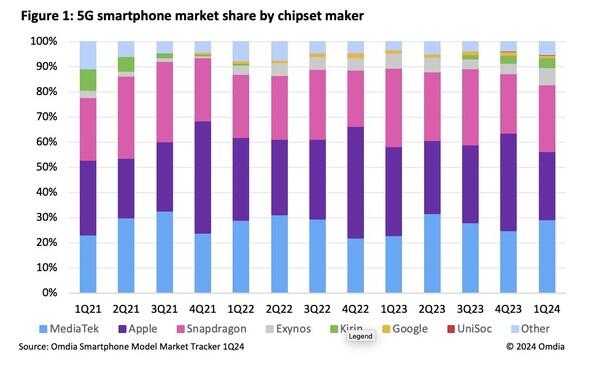

LONDON, July 8, 2024 /PRNewswire/ — 5G smartphones equipped with MediaTek chipsets experienced robust growth of 53%, increasing to 53.0 million in 1Q24 from 34.7 million in 1Q23, according to the latest Omdia Smartphone Model Market Tracker. In contrast, Snapdragon-powered devices remained relatively stable, with shipments changing minimally from 47.2 million units in 1Q23 to 48.3 million in 1Q24.

MediaTek’s market share in 5G smartphones rose to 29.2% in 1Q24, up from 22.8% in 1Q23, while Qualcomm Snapdragon’s share decreased from 31.2% to 26.5% over the same period. Figure 1 illustrates MediaTek leading followed by Apple and Snapdragon.

5G smartphone market by chipset maker

Other chipset manufacturers, such as Exynos, Google, Kirin and UniSoC collectively account for 17% of shipments. This share has increased in the past year driven by Kirin’s growth, particularly with the Huawei Mate 60 Pro and Nova 12 series. Following HiSilicon’s announcement to cease Kirin chipset production from September 15, 2020amid ongoing trade tensions between Huawei and the United Statesthe Kirin 9000s chipset concluded its production in August 2023.

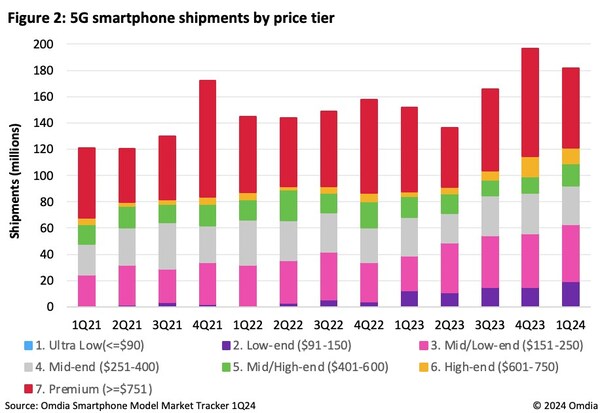

MediaTek’s expansion over Snapdragon in the 5G smartphone market is largely attributed to the increasing availability of phones priced under $250 equipped with 5G chipsets – a segment dominated by MediaTek. According to figure 2, shipments of 5G smartphones below $250 surged by 62%, from 38.7 million in 1Q23 to 62.8 million in 1Q24. This has particularly favored MediaTek, as it is the preferred choice in this price range for 5G phones, while Snapdragon leads in mid-range 5G phones and Apple dominates the premium segment.

5G smartphone shipments by price tier

Over the past three years, as most chipset makers shifted from producing 4G to 5G chipsets, UniSoC has capitalized on the opportunity to increase its share in the declining 4G market. UniSoC is now MediaTek’s primary competitor in this sector. During this period, Apple, Exynos and Snapdragon underwent significant transitions in their chipset portfolios, focusing heavily on 5G technology. For instance, Exynos reduced its reliance on 4G chipsets from 77% of smartphone shipments in 1Q21 to just 1% in 1Q24. In comparison, MediaTek continues to use 4G chipsets for over 50% of its shipments.

Aaron WestSenior Analyst in Omdia’s Smartphone group explains: “The smartphone chipset industry is primarily shaped by two major trends: the widespread adoption of 5G and the expanding low-end segment. As 5G technology becomes more affordable and is integrated into smartphones priced below $250MediaTek stands to benefit the most. Conversely, on-device AI capabilities are becoming increasingly important to smartphone OEMs, with Snapdragon emerging as a key innovator and preferred choice for premium devices.”

ABOUT OMDIA

Omdiapart of Informa Tech, is a technology research and advisory group. Our deep knowledge of tech markets combined with our actionable insights empower organizations to make smart growth decisions.

Contact: faseeha khan – Fasiha.khan@omdia.com

Hot Deals

Hot Deals Shopfinish

Shopfinish Shop

Shop Appliances

Appliances Babies & Kids

Babies & Kids Best Selling

Best Selling Books

Books Consumer Electronics

Consumer Electronics Furniture

Furniture Home & Kitchen

Home & Kitchen Jewelry

Jewelry Luxury & Beauty

Luxury & Beauty Shoes

Shoes Training & Certifications

Training & Certifications Wears & Clothings

Wears & Clothings