Business new tamfitronics

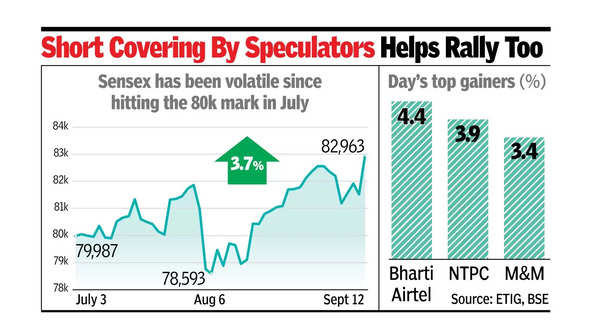

MUMBAI: Across-the-board buying lifted the Sensex by over 1,400 points or 1.8% on Thursday to over the 83K mark for the first time.

Global markets, which rallied on hopes of a rate cut in the US next week, boosted investor sentiment on

Dalal Street

. Short covering of positions by speculators, too, helped the domestic rally towards the end of the session, market players said.

The day’s rally added about Rs 6.5 lakh crore to investors’ wealth, with BSE’s market capitalisation now at Rs 480.5 lakh crore.

The Sensex opened the session in the green, was up about 400 points at 81,930, slid slightly due to profit-booking in blue chips and then rallied sharply in the closing hours to record a new all-time high at 83,116. At close, it was at 82,963, up 1,440 points. On the NSE, Nifty too recorded a new life-high at 25,433, and closed at 25,389 – up 470 points. Strong buying on the day of the monthly derivatives contract expiry also helped the rally, market players said.

According to Prashanth Tapse of Mehta Equities, across-the-board buying support lifted both benchmarks to record highs as falling US bond yields and expectations of a rate cut by the US Federal Reserve next week fueled massive optimism. “Although the US CPI data may not be encouraging for aggressive rate cuts, recent economic readings showed the economy could be facing challenges going ahead, and hence the (US) Fed may go for a rate cut,” he said. Tapse believes that with retail money continuing to flow into the domestic market despite concerns of stretched valuations, investors remain upbeat about India’s resilience amid a slowing global economy.

The day’s rally on Dalal Street was boosted by a Rs 7,695-crore net buying by foreign funds while domestic funds booked profit, recording a net selling figure of Rs 1,801 crore.