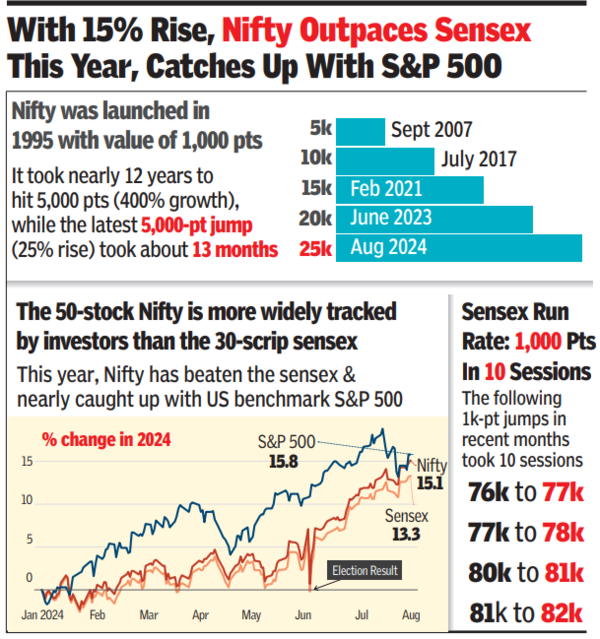

Sensex hits 82,000, Nifty 25,000 for 1st time as US rate cut nears

Business new tamfitronics

MUMBAI: A strong US market close the previous night backed by dovish comments by the

Fed chief

lifted sentiment on

Dalal Street

on Thursday which saw the sensex break above the 82,000 mark for the first time and the Nifty above the 25,000 milestone. The indices, however, closed lower than their respective all-time highs as profit taking at higher levels had set in due to the rising geopolitical tensions in West Asia, market players said.

The day’s session started on a high note with the sensex rallying to an intraday high at 82,129 points while Nifty recorded its all-time high at 25,078 points.

At close, the sensex was at 81,868 points, up 126 points (0.2%) while Nifty was at 25,011 points, up 60 points (0.2%).

Outside of the leading indices, there was strong selling due to the brewing tensions between Israel, Lebanon, Iran and some other countries in West Asia. As a result, BSE’s midcap index closed 0.8% lower while the smallcap index was down 0.7%.

According to Vinod Nair of Geojit Financial Services, the domestic market started on a positive note, taking cues from the global market following the US Federal Reserve chairman’s indication that a rate cut in the world’s largest economy could come as soon as Sept, mainly because of easing inflationary pressures. “However, the broader market closed (with) a negative bias due to escalating geopolitical tensions in (West Asia) leading to rising crude oil prices.”

On a sectoral basis, capital goods and realty were impacted by profit-booking coupled with auto sectors owing to below-expected monthly auto sales figures, Nair wrote in a note. The session’s negative undercurrent pulled down investors’ wealth by about Rs 70,000 crore with BSE’s market capitalisation now at nearly Rs 475 lakh crore. While midcap and smallcap stocks have made significant gains in the past few months, it is believed that large-cap stocks may see increased investor interest in the near future, said Neeraj Chadawar of Axis Securities

In Thursday’s market, HDFC Bank, Reliance Industries and PowerGrid contributed the most to the sensex’s gain but selling in Mahindra, Infosys and L&T moderated its rise. Foreign funds were net buyers in Thursday’s market with a net inflow figure of Rs 2,089 crore while domestic institutions were net sellers at Rs 337 crore, BSE data showed.

Discover more from Tamfis Nigeria Lmited

Subscribe to get the latest posts sent to your email.

Hot Deals

Hot Deals Shopfinish

Shopfinish Shop

Shop Appliances

Appliances Babies & Kids

Babies & Kids Best Selling

Best Selling Books

Books Consumer Electronics

Consumer Electronics Furniture

Furniture Home & Kitchen

Home & Kitchen Jewelry

Jewelry Luxury & Beauty

Luxury & Beauty Shoes

Shoes Training & Certifications

Training & Certifications Wears & Clothings

Wears & Clothings