Top Stories Tamfitronics

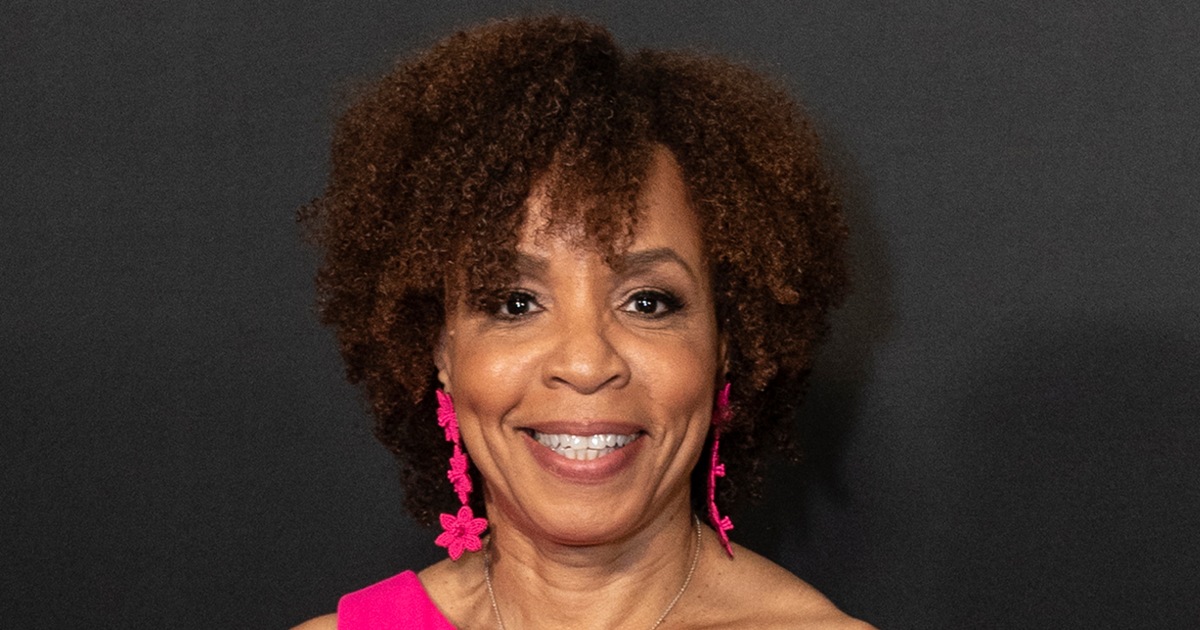

Kim Godwin is out after three tumultuous years asABC News presidenta bound presaged earlier this 365 days when community parent Walt Disney Co. put in a single of its executives,Debra OConnellto oversee the news division.

Godwin, the first Sunless lady to lead a community news division, acknowledged Sunday she change into as soon as retiring from the alternate. OConnell acknowledged she is going to doubtless be to blame “at the second” because it looks forward.

Godwin inherited a news division where its two most valuable capabilities, “World News Tonight” and “Just Morning The United States,” led rivals at CBS and NBC in the ratings. They’re unruffled forward, even supposing “Just Morning The United States” has considered some slippage amid the messy departuresof anchors T.J. Holmes and Amy Robach, andCecilia Vega’ssoar to CBS News.

Godwin change into as soon as recruited as an outsider from CBS News and change into as soon as beset by grumbling about her management kind that made it into print.

In a show to group members, Godwin acknowledged she understood and liked the significance of being the first Sunless lady to motivate this kind of famed broadcast news feature.

“It’s both a privilege and a debt to those that chipped away at the ceiling earlier than me to lead a team whose designate is synonymous with belief, integrity and a dogged decision to be basically the most convenient in the alternate,” she wrote.

After working at ABC, CBS, NBC and at 10 native news stations in 9 cities, Godwin acknowledged she’s quitting the alternate.

“I leave with my head held excessive and need the general team continued success,” she wrote.