Politics tamfitronics

Wednesday, 30/10/2024 | 12:07 GMT by Andy Lian

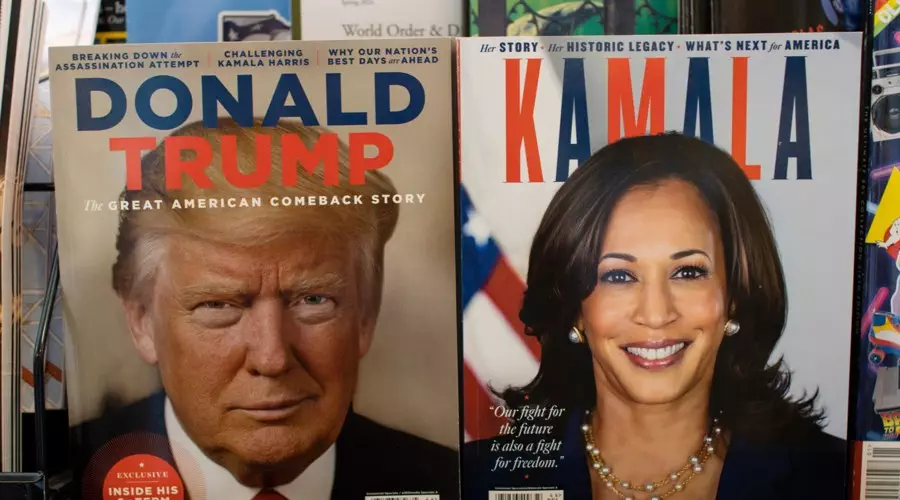

- Donald Trump wants to become the first “Bitcoin President”while Kamala Harris promised crypto innovation.

- A Trump victory could lead to a continuation of the deregulatory approach, but a Harris administration would likely prioritise consumer protection and financial stability.

As the United States gears up for anothersignificant presidential election, the intersection of politics andcryptocurrency has emerged as a critical area of focus. The candidates, former PresidentDonald Trump and Vice President Kamala Harris, offer contrasting visions forthe future of digital currencies and blockchain technology. This divergence isnot only shaping the political landscape but also influencing financialmarkets, particularly the rapidly growing cryptocurrency sector.

The Crypto Landscape Amidst PoliticalUncertainty

Cryptocurrency, once a niche interest, hasevolved into a major financial force. Its decentralised nature and potentialfor high returns have attracted a wide range of investors, from tech-savvymillennials to institutional giants. However, the regulatory environmentremains uncertain, with policymakers grappling with how to integrate thesedigital assets into the existing financial system.

In this context, the upcoming U.S.presidential election could be a turning point. The candidates’ differingapproaches to cryptocurrency regulation and adoption could have profoundimplications for the industry. As such, the election is not just a politicalcontest but a referendum on the future of digital finance.

Wall Street’s Bet on Trump

Wall Street’s apparent preference for aTrump victory is rooted in his administration’s historical approach toregulation and taxation. Trump’s presidency was marked by a deregulatoryagenda, which many investors believe could benefit the cryptocurrency industry.Lower taxes and fewer regulations could create a more favourable environmentfor crypto businesses, potentially spurring innovation and growth.

This sentiment is reflected in the behaviourof prediction markets, where Trump’s odds of winning have surged. Platformslike Polymarket and PredictIt have seen significant bets placed on a Trumpvictory, with some investors wagering millions of dollars. These markets, whichallow users to bet on the outcome of events using cryptocurrency, have become abarometer of investor sentiment.

One week until the election.

🟥 Trump • 66% chance

🟦 Harris • 34% chanceGet accurate, real-time election odds on the world’s largest prediction market #Polymarket

— Polymarket (@Polymarket) October 29, 2024

The enthusiasm for Trump among cryptoinvestors is not surprising. During his previous term, Trump expressed scepticismabout cryptocurrencies but refrained from implementing harsh regulations. Hisadministration’s focus on economic growth and deregulation aligns with theinterests of many in the crypto community, who view excessive regulation as abarrier to innovation.

Harris and the Promise of Innovation

In contrast, Vice President Kamala Harrisrepresents a more cautious approach to cryptocurrency. While she has not beenas vocal about her stance on digital currencies, her campaign has emphasisedthe importance of innovation and technology. Harris has promised to encouragethe development of emerging technologies, including artificial intelligence anddigital assets, while ensuring consumer protection and financial stability.

Harris’s approach reflects a broaderDemocratic strategy of balancing innovation with regulation. Her administrationwould likely prioritise consumer protection and financial stability,potentially leading to stricter regulations on cryptocurrencies. This couldinclude measures to prevent fraud, protect investors, and ensure the stabilityof the financial system.

Despite these potential challenges,Harris’s focus on innovation could also benefit the crypto industry. Byfostering a supportive environment for technological development, heradministration could encourage the growth of blockchain technology and digitalassets. This could lead to new opportunities for entrepreneurs and investors,even if it means navigating a more complex regulatory landscape.

The Role of Prediction Markets

The divergence between traditional pollsand prediction markets highlights the unique dynamics of this election. Whilemany polls show a close race between Trump and Harris, prediction markets haveconsistently favoured Trump. This discrepancy can be attributed to severalfactors, including the influence of large investors, or “whales,” whohave placed substantial bets on a Trump victory.

These markets, which operate on blockchaintechnology, offer a decentralized platform for betting on the outcome ofevents. They have gained popularity in recent years, particularly among cryptoenthusiasts who appreciate their transparency and accessibility. However, theirpredictions should be interpreted with caution, as they reflect the views of aspecific subset of investors rather than the broader electorate.

The influence of prediction markets onmedia coverage is also noteworthy. As these platforms have gained prominence,their odds have been cited as evidence of Trump’s growing lead. This hascontributed to a narrative that may not fully align with traditional pollingdata, underscoring the complex relationship between media, markets, and publicperception.

Latest Swing State Odds

🟥 Arizona • Trump 74% – Harris 26%

🟥 Georgia • Trump 73% – Harris 27%

🟥 Wisconsin • Trump 59% – Harris 41%

🟥 Michigan • Trump 53% – Harris 47%

🟥 Nevada • Trump 66% – Harris 34%

🟥 Pennsylvania • Trump 62% – Harris 38% pic.twitter.com/8CdT68AfRx— Polymarket (@Polymarket) October 29, 2024

The Future of Cryptocurrency Regulation

The outcome of the election will havesignificant implications for the future of cryptocurrency regulation in the UnitedStates. A Trump victory could lead to a continuation of the deregulatoryapproach that characterised his previous administration. This could create amore favourable environment for crypto businesses, potentially attractinginvestment and fostering innovation.

On the other hand, a Harris administrationwould likely prioritise consumer protection and financial stability,potentially leading to stricter regulations. While this could pose challengesfor the industry, it could also provide a more stable and secure environmentfor investors, ultimately benefiting the market’s long-term growth.

Regardless of the outcome, the electionwill serve as a critical juncture for the cryptocurrency industry. As digitalcurrencies continue to gain traction, policymakers will need to strike abalance between fostering innovation and ensuring the stability and security ofthe financial system. This will require collaboration between regulators,industry leaders, and other stakeholders to develop a regulatory framework thatsupports the growth of digital finance while protecting consumers andmaintaining financial stability.

Fire Gary Gensler

Provide fair regulations that promote innovation and equality through decentralization

Provide disclosures

Give the same freedom to retail as accredited investors get pic.twitter.com/eHbWcBzmq1

— Wendy O (@CryptoWendyO) October 24, 2024

Conclusion: A Pivotal Moment for Crypto

The U.S. presidential election is a pivotalmoment for the cryptocurrency industry. The candidates’ differing approaches toregulation and innovation will shape the future of digital finance, influencingeverything from market dynamics to investor sentiment. As such, the election isnot just a political contest but a referendum on the future of cryptocurrency.

For investors and industry leaders, thestakes are high. A Trump victory could lead to a continuation of thederegulatory approach that has benefited the industry, while a Harrisadministration could introduce new challenges and opportunities. Regardless ofthe outcome, the election will serve as a critical juncture for thecryptocurrency industry, shaping its trajectory for years to come.

As the election approaches, the crypto communitywill be watching closely, eager to see how the outcome will impact the futureof digital finance. Whether through deregulation or innovation, the nextadministration will play a crucial role in shaping the future ofcryptocurrency, influencing everything from market dynamics to investorsentiment. In this context, the election is not just a political contest but areferendum on the future of digital finance.

As the United States gears up for anothersignificant presidential election, the intersection of politics andcryptocurrency has emerged as a critical area of focus. The candidates, former PresidentDonald Trump and Vice President Kamala Harris, offer contrasting visions forthe future of digital currencies and blockchain technology. This divergence isnot only shaping the political landscape but also influencing financialmarkets, particularly the rapidly growing cryptocurrency sector.

The Crypto Landscape Amidst PoliticalUncertainty

Cryptocurrency, once a niche interest, hasevolved into a major financial force. Its decentralised nature and potentialfor high returns have attracted a wide range of investors, from tech-savvymillennials to institutional giants. However, the regulatory environmentremains uncertain, with policymakers grappling with how to integrate thesedigital assets into the existing financial system.

In this context, the upcoming U.S.presidential election could be a turning point. The candidates’ differingapproaches to cryptocurrency regulation and adoption could have profoundimplications for the industry. As such, the election is not just a politicalcontest but a referendum on the future of digital finance.

Wall Street’s Bet on Trump

Wall Street’s apparent preference for aTrump victory is rooted in his administration’s historical approach toregulation and taxation. Trump’s presidency was marked by a deregulatoryagenda, which many investors believe could benefit the cryptocurrency industry.Lower taxes and fewer regulations could create a more favourable environmentfor crypto businesses, potentially spurring innovation and growth.

This sentiment is reflected in the behaviourof prediction markets, where Trump’s odds of winning have surged. Platformslike Polymarket and PredictIt have seen significant bets placed on a Trumpvictory, with some investors wagering millions of dollars. These markets, whichallow users to bet on the outcome of events using cryptocurrency, have become abarometer of investor sentiment.

One week until the election.

🟥 Trump • 66% chance

🟦 Harris • 34% chanceGet accurate, real-time election odds on the world’s largest prediction market #Polymarket

— Polymarket (@Polymarket) October 29, 2024

The enthusiasm for Trump among cryptoinvestors is not surprising. During his previous term, Trump expressed scepticismabout cryptocurrencies but refrained from implementing harsh regulations. Hisadministration’s focus on economic growth and deregulation aligns with theinterests of many in the crypto community, who view excessive regulation as abarrier to innovation.

Harris and the Promise of Innovation

In contrast, Vice President Kamala Harrisrepresents a more cautious approach to cryptocurrency. While she has not beenas vocal about her stance on digital currencies, her campaign has emphasisedthe importance of innovation and technology. Harris has promised to encouragethe development of emerging technologies, including artificial intelligence anddigital assets, while ensuring consumer protection and financial stability.

Harris’s approach reflects a broaderDemocratic strategy of balancing innovation with regulation. Her administrationwould likely prioritise consumer protection and financial stability,potentially leading to stricter regulations on cryptocurrencies. This couldinclude measures to prevent fraud, protect investors, and ensure the stabilityof the financial system.

Despite these potential challenges,Harris’s focus on innovation could also benefit the crypto industry. Byfostering a supportive environment for technological development, heradministration could encourage the growth of blockchain technology and digitalassets. This could lead to new opportunities for entrepreneurs and investors,even if it means navigating a more complex regulatory landscape.

The Role of Prediction Markets

The divergence between traditional pollsand prediction markets highlights the unique dynamics of this election. Whilemany polls show a close race between Trump and Harris, prediction markets haveconsistently favoured Trump. This discrepancy can be attributed to severalfactors, including the influence of large investors, or “whales,” whohave placed substantial bets on a Trump victory.

These markets, which operate on blockchaintechnology, offer a decentralized platform for betting on the outcome ofevents. They have gained popularity in recent years, particularly among cryptoenthusiasts who appreciate their transparency and accessibility. However, theirpredictions should be interpreted with caution, as they reflect the views of aspecific subset of investors rather than the broader electorate.

The influence of prediction markets onmedia coverage is also noteworthy. As these platforms have gained prominence,their odds have been cited as evidence of Trump’s growing lead. This hascontributed to a narrative that may not fully align with traditional pollingdata, underscoring the complex relationship between media, markets, and publicperception.

Latest Swing State Odds

🟥 Arizona • Trump 74% – Harris 26%

🟥 Georgia • Trump 73% – Harris 27%

🟥 Wisconsin • Trump 59% – Harris 41%

🟥 Michigan • Trump 53% – Harris 47%

🟥 Nevada • Trump 66% – Harris 34%

🟥 Pennsylvania • Trump 62% – Harris 38% pic.twitter.com/8CdT68AfRx— Polymarket (@Polymarket) October 29, 2024

The Future of Cryptocurrency Regulation

The outcome of the election will havesignificant implications for the future of cryptocurrency regulation in the UnitedStates. A Trump victory could lead to a continuation of the deregulatoryapproach that characterised his previous administration. This could create amore favourable environment for crypto businesses, potentially attractinginvestment and fostering innovation.

On the other hand, a Harris administrationwould likely prioritise consumer protection and financial stability,potentially leading to stricter regulations. While this could pose challengesfor the industry, it could also provide a more stable and secure environmentfor investors, ultimately benefiting the market’s long-term growth.

Regardless of the outcome, the electionwill serve as a critical juncture for the cryptocurrency industry. As digitalcurrencies continue to gain traction, policymakers will need to strike abalance between fostering innovation and ensuring the stability and security ofthe financial system. This will require collaboration between regulators,industry leaders, and other stakeholders to develop a regulatory framework thatsupports the growth of digital finance while protecting consumers andmaintaining financial stability.

Fire Gary Gensler

Provide fair regulations that promote innovation and equality through decentralization

Provide disclosures

Give the same freedom to retail as accredited investors get pic.twitter.com/eHbWcBzmq1

— Wendy O (@CryptoWendyO) October 24, 2024

Conclusion: A Pivotal Moment for Crypto

The U.S. presidential election is a pivotalmoment for the cryptocurrency industry. The candidates’ differing approaches toregulation and innovation will shape the future of digital finance, influencingeverything from market dynamics to investor sentiment. As such, the election isnot just a political contest but a referendum on the future of cryptocurrency.

For investors and industry leaders, thestakes are high. A Trump victory could lead to a continuation of thederegulatory approach that has benefited the industry, while a Harrisadministration could introduce new challenges and opportunities. Regardless ofthe outcome, the election will serve as a critical juncture for thecryptocurrency industry, shaping its trajectory for years to come.

As the election approaches, the crypto communitywill be watching closely, eager to see how the outcome will impact the futureof digital finance. Whether through deregulation or innovation, the nextadministration will play a crucial role in shaping the future ofcryptocurrency, influencing everything from market dynamics to investorsentiment. In this context, the election is not just a political contest but areferendum on the future of digital finance.

- 18 Articles

- 8 Followers

Anndy Lian is an all-rounded business strategist in Asia. He has provided advisory across a variety of industries for local, international, public listed companies and governments. He is an early blockchain adopter and experienced serial entrepreneur, book author, investor, board member and keynote speaker.

Keep Reading

More from the Author

-

What Singapore should do for Token Regulation: My Suggestions for Proposed DTSPs Framework

What Singapore should do for Token Regulation: My Suggestions for Proposed DTSPs Framework

What Singapore should do for Token Regulation: My Suggestions for Proposed DTSPs Framework

What Singapore should do for Token Regulation: My Suggestions for Proposed DTSPs Framework

What Singapore should do for Token Regulation: My Suggestions for Proposed DTSPs Framework

What Singapore should do for Token Regulation: My Suggestions for Proposed DTSPs Framework

What Singapore should do for Token Regulation: My Suggestions for Proposed DTSPs Framework

What Singapore should do for Token Regulation: My Suggestions for Proposed DTSPs Framework

What Singapore should do for Token Regulation: My Suggestions for Proposed DTSPs Framework

What Singapore should do for Token Regulation: My Suggestions for Proposed DTSPs Framework

-

Why You Should Consider Investing in These Three Cryptocurrencies

Why You Should Consider Investing in These Three Cryptocurrencies

Why You Should Consider Investing in These Three Cryptocurrencies

Why You Should Consider Investing in These Three Cryptocurrencies

Why You Should Consider Investing in These Three Cryptocurrencies

Why You Should Consider Investing in These Three Cryptocurrencies

Why You Should Consider Investing in These Three Cryptocurrencies

Why You Should Consider Investing in These Three Cryptocurrencies

Why You Should Consider Investing in These Three Cryptocurrencies

Why You Should Consider Investing in These Three Cryptocurrencies

-

Decoding Crypto Investment: The Scientific Strategy for Venture Capitalists

Decoding Crypto Investment: The Scientific Strategy for Venture Capitalists

Decoding Crypto Investment: The Scientific Strategy for Venture Capitalists

Decoding Crypto Investment: The Scientific Strategy for Venture Capitalists

Decoding Crypto Investment: The Scientific Strategy for Venture Capitalists

Decoding Crypto Investment: The Scientific Strategy for Venture Capitalists

Decoding Crypto Investment: The Scientific Strategy for Venture Capitalists

Decoding Crypto Investment: The Scientific Strategy for Venture Capitalists

Decoding Crypto Investment: The Scientific Strategy for Venture Capitalists

Decoding Crypto Investment: The Scientific Strategy for Venture Capitalists

-

Decentralized Transactions Challenge Howey Test’s Application to NFTs

Decentralized Transactions Challenge Howey Test’s Application to NFTs

Decentralized Transactions Challenge Howey Test’s Application to NFTs

Decentralized Transactions Challenge Howey Test’s Application to NFTs

Decentralized Transactions Challenge Howey Test’s Application to NFTs

Decentralized Transactions Challenge Howey Test’s Application to NFTs

Decentralized Transactions Challenge Howey Test’s Application to NFTs

Decentralized Transactions Challenge Howey Test’s Application to NFTs

Decentralized Transactions Challenge Howey Test’s Application to NFTs

Decentralized Transactions Challenge Howey Test’s Application to NFTs

-

Crypto and Web3 Outlook 2024: Innovations in User Experience Driving Adoption

Crypto and Web3 Outlook 2024: Innovations in User Experience Driving Adoption

Crypto and Web3 Outlook 2024: Innovations in User Experience Driving Adoption

Crypto and Web3 Outlook 2024: Innovations in User Experience Driving Adoption

Crypto and Web3 Outlook 2024: Innovations in User Experience Driving Adoption

Crypto and Web3 Outlook 2024: Innovations in User Experience Driving Adoption

Crypto and Web3 Outlook 2024: Innovations in User Experience Driving Adoption

Crypto and Web3 Outlook 2024: Innovations in User Experience Driving Adoption

Crypto and Web3 Outlook 2024: Innovations in User Experience Driving Adoption

Crypto and Web3 Outlook 2024: Innovations in User Experience Driving Adoption

-

AI and Blockchain Convergence to Reshape Crypto and Web3 in 2024

AI and Blockchain Convergence to Reshape Crypto and Web3 in 2024

AI and Blockchain Convergence to Reshape Crypto and Web3 in 2024

AI and Blockchain Convergence to Reshape Crypto and Web3 in 2024

AI and Blockchain Convergence to Reshape Crypto and Web3 in 2024

AI and Blockchain Convergence to Reshape Crypto and Web3 in 2024

AI and Blockchain Convergence to Reshape Crypto and Web3 in 2024

AI and Blockchain Convergence to Reshape Crypto and Web3 in 2024

AI and Blockchain Convergence to Reshape Crypto and Web3 in 2024

AI and Blockchain Convergence to Reshape Crypto and Web3 in 2024

CryptoCurrency

-

Africa Crypto Surge Hits 189% as Youth Choose Telegram over Traditional Banking

Africa Crypto Surge Hits 189% as Youth Choose Telegram over Traditional Banking

Africa Crypto Surge Hits 189% as Youth Choose Telegram over Traditional Banking

Africa Crypto Surge Hits 189% as Youth Choose Telegram over Traditional Banking

Africa Crypto Surge Hits 189% as Youth Choose Telegram over Traditional Banking

Africa Crypto Surge Hits 189% as Youth Choose Telegram over Traditional Banking

Africa Crypto Surge Hits 189% as Youth Choose Telegram over Traditional Banking

Africa Crypto Surge Hits 189% as Youth Choose Telegram over Traditional Banking

Africa Crypto Surge Hits 189% as Youth Choose Telegram over Traditional Banking

Africa Crypto Surge Hits 189% as Youth Choose Telegram over Traditional Banking

-

Binance Unveils Wealth Management Platform for High-Net-Worth Investors

Binance Unveils Wealth Management Platform for High-Net-Worth Investors

Binance Unveils Wealth Management Platform for High-Net-Worth Investors

Binance Unveils Wealth Management Platform for High-Net-Worth Investors

Binance Unveils Wealth Management Platform for High-Net-Worth Investors

Binance Unveils Wealth Management Platform for High-Net-Worth Investors

Binance Unveils Wealth Management Platform for High-Net-Worth Investors

Binance Unveils Wealth Management Platform for High-Net-Worth Investors

Binance Unveils Wealth Management Platform for High-Net-Worth Investors

Binance Unveils Wealth Management Platform for High-Net-Worth Investors

-

FTX’s Alameda Research Sues KuCoin to Recover $50 Million in Frozen Assets

FTX’s Alameda Research Sues KuCoin to Recover $50 Million in Frozen Assets

FTX’s Alameda Research Sues KuCoin to Recover $50 Million in Frozen Assets

FTX’s Alameda Research Sues KuCoin to Recover $50 Million in Frozen Assets

FTX’s Alameda Research Sues KuCoin to Recover $50 Million in Frozen Assets

FTX’s Alameda Research Sues KuCoin to Recover $50 Million in Frozen Assets

FTX’s Alameda Research Sues KuCoin to Recover $50 Million in Frozen Assets

FTX’s Alameda Research Sues KuCoin to Recover $50 Million in Frozen Assets

FTX’s Alameda Research Sues KuCoin to Recover $50 Million in Frozen Assets

FTX’s Alameda Research Sues KuCoin to Recover $50 Million in Frozen Assets

-

Gemini Gains In-Principle Approval from MAS for Cross-Border and Crypto Payment

Gemini Gains In-Principle Approval from MAS for Cross-Border and Crypto Payment

Gemini Gains In-Principle Approval from MAS for Cross-Border and Crypto Payment

Gemini Gains In-Principle Approval from MAS for Cross-Border and Crypto Payment

Gemini Gains In-Principle Approval from MAS for Cross-Border and Crypto Payment

Gemini Gains In-Principle Approval from MAS for Cross-Border and Crypto Payment

Gemini Gains In-Principle Approval from MAS for Cross-Border and Crypto Payment

Gemini Gains In-Principle Approval from MAS for Cross-Border and Crypto Payment

Gemini Gains In-Principle Approval from MAS for Cross-Border and Crypto Payment

Gemini Gains In-Principle Approval from MAS for Cross-Border and Crypto Payment

-

OKX Chooses Standard Chartered as Custodian for Institutional Crypto Services

OKX Chooses Standard Chartered as Custodian for Institutional Crypto Services

OKX Chooses Standard Chartered as Custodian for Institutional Crypto Services

OKX Chooses Standard Chartered as Custodian for Institutional Crypto Services

OKX Chooses Standard Chartered as Custodian for Institutional Crypto Services

OKX Chooses Standard Chartered as Custodian for Institutional Crypto Services

OKX Chooses Standard Chartered as Custodian for Institutional Crypto Services

OKX Chooses Standard Chartered as Custodian for Institutional Crypto Services

OKX Chooses Standard Chartered as Custodian for Institutional Crypto Services

OKX Chooses Standard Chartered as Custodian for Institutional Crypto Services

-

Silk Road-Linked Money Laundering: US Charges Bitcoin Exchange Operator

Silk Road-Linked Money Laundering: US Charges Bitcoin Exchange Operator

Silk Road-Linked Money Laundering: US Charges Bitcoin Exchange Operator

Silk Road-Linked Money Laundering: US Charges Bitcoin Exchange Operator

Silk Road-Linked Money Laundering: US Charges Bitcoin Exchange Operator

Silk Road-Linked Money Laundering: US Charges Bitcoin Exchange Operator

Silk Road-Linked Money Laundering: US Charges Bitcoin Exchange Operator

Silk Road-Linked Money Laundering: US Charges Bitcoin Exchange Operator

Silk Road-Linked Money Laundering: US Charges Bitcoin Exchange Operator

Silk Road-Linked Money Laundering: US Charges Bitcoin Exchange Operator

-

Africa Crypto Surge Hits 189% as Youth Choose Telegram over Traditional Banking

Africa Crypto Surge Hits 189% as Youth Choose Telegram over Traditional Banking

-

Binance Unveils Wealth Management Platform for High-Net-Worth Investors

Binance Unveils Wealth Management Platform for High-Net-Worth Investors

-

FTX’s Alameda Research Sues KuCoin to Recover $50 Million in Frozen Assets

FTX’s Alameda Research Sues KuCoin to Recover $50 Million in Frozen Assets

-

Gemini Gains In-Principle Approval from MAS for Cross-Border and Crypto Payment

Gemini Gains In-Principle Approval from MAS for Cross-Border and Crypto Payment

Featured Videos

FM’s Andrea Badiola Mateos at LSEG’s Cyprus event

FM’s Andrea Badiola Mateos at LSEG’s Cyprus event

FM’s Andrea Badiola Mateos at LSEG’s Cyprus event

FM’s Andrea Badiola Mateos at LSEG’s Cyprus event

FM’s Andrea Badiola Mateos at speaking in a panel discussion at LSEG’s Cyprus event

FM’s Andrea Badiola Mateos at speaking in a panel discussion at LSEG’s Cyprus event

FM’s Andrea Badiola Mateos at speaking in a panel discussion at LSEG’s Cyprus event

FM’s Andrea Badiola Mateos at speaking in a panel discussion at LSEG’s Cyprus event

More Videos

-

The Role of PAMM, MAM & Copy Trading in Business Growth Strategies | Webinar

The Role of PAMM, MAM & Copy Trading in Business Growth Strategies | Webinar

The Role of PAMM, MAM & Copy Trading in Business Growth Strategies | Webinar

The Role of PAMM, MAM & Copy Trading in Business Growth Strategies | Webinar

The Role of PAMM, MAM & Copy Trading in Business Growth Strategies | Webinar

The Role of PAMM, MAM & Copy Trading in Business Growth Strategies | Webinar

The copy trading market is projected to double in size, growing from $2.2 billion to $4 billion by the end of this decade. In light of this, brokers and financial institutions are increasingly adopting PAMM, MAM, and Copy Trading solutions to scale operations and drive profitability. In this insightful webinar, Sergey Ryzhavin, Product Owner at B2COPY, outlines the advanced features of the B2COPY platform, showcasing how it enhances Copy Trading, PAMM, and MAM performance. Sergey also explores strategies for using these tools to attract new clients, improve customer engagement, and create additional revenue streams.📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today:🔗 LinkedIn: https://www.linkedin.com/company/financemagnates/👍 Facebook: https://www.facebook.com/financemagnates/📸 Instagram: https://www.instagram.com/financemagnates_official🐦 X (Twitter): https://twitter.com/financemagnates/📡 RSS Feed: https://www.financemagnates.com/feed/▶️ Telegram: https://t.me/financemagnatesnewsDon’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

The copy trading market is projected to double in size, growing from $2.2 billion to $4 billion by the end of this decade. In light of this, brokers and financial institutions are increasingly adopting PAMM, MAM, and Copy Trading solutions to scale operations and drive profitability. In this insightful webinar, Sergey Ryzhavin, Product Owner at B2COPY, outlines the advanced features of the B2COPY platform, showcasing how it enhances Copy Trading, PAMM, and MAM performance. Sergey also explores strategies for using these tools to attract new clients, improve customer engagement, and create additional revenue streams.📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today:🔗 LinkedIn: https://www.linkedin.com/company/financemagnates/👍 Facebook: https://www.facebook.com/financemagnates/📸 Instagram: https://www.instagram.com/financemagnates_official🐦 X (Twitter): https://twitter.com/financemagnates/📡 RSS Feed: https://www.financemagnates.com/feed/▶️ Telegram: https://t.me/financemagnatesnewsDon’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

The copy trading market is projected to double in size, growing from $2.2 billion to $4 billion by the end of this decade. In light of this, brokers and financial institutions are increasingly adopting PAMM, MAM, and Copy Trading solutions to scale operations and drive profitability. In this insightful webinar, Sergey Ryzhavin, Product Owner at B2COPY, outlines the advanced features of the B2COPY platform, showcasing how it enhances Copy Trading, PAMM, and MAM performance. Sergey also explores strategies for using these tools to attract new clients, improve customer engagement, and create additional revenue streams.📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today:🔗 LinkedIn: https://www.linkedin.com/company/financemagnates/👍 Facebook: https://www.facebook.com/financemagnates/📸 Instagram: https://www.instagram.com/financemagnates_official🐦 X (Twitter): https://twitter.com/financemagnates/📡 RSS Feed: https://www.financemagnates.com/feed/▶️ Telegram: https://t.me/financemagnatesnewsDon’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

The copy trading market is projected to double in size, growing from $2.2 billion to $4 billion by the end of this decade. In light of this, brokers and financial institutions are increasingly adopting PAMM, MAM, and Copy Trading solutions to scale operations and drive profitability. In this insightful webinar, Sergey Ryzhavin, Product Owner at B2COPY, outlines the advanced features of the B2COPY platform, showcasing how it enhances Copy Trading, PAMM, and MAM performance. Sergey also explores strategies for using these tools to attract new clients, improve customer engagement, and create additional revenue streams.📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today:🔗 LinkedIn: https://www.linkedin.com/company/financemagnates/👍 Facebook: https://www.facebook.com/financemagnates/📸 Instagram: https://www.instagram.com/financemagnates_official🐦 X (Twitter): https://twitter.com/financemagnates/📡 RSS Feed: https://www.financemagnates.com/feed/▶️ Telegram: https://t.me/financemagnatesnewsDon’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

The copy trading market is projected to double in size, growing from $2.2 billion to $4 billion by the end of this decade. In light of this, brokers and financial institutions are increasingly adopting PAMM, MAM, and Copy Trading solutions to scale operations and drive profitability. In this insightful webinar, Sergey Ryzhavin, Product Owner at B2COPY, outlines the advanced features of the B2COPY platform, showcasing how it enhances Copy Trading, PAMM, and MAM performance. Sergey also explores strategies for using these tools to attract new clients, improve customer engagement, and create additional revenue streams.📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today:🔗 LinkedIn: https://www.linkedin.com/company/financemagnates/👍 Facebook: https://www.facebook.com/financemagnates/📸 Instagram: https://www.instagram.com/financemagnates_official🐦 X (Twitter): https://twitter.com/financemagnates/📡 RSS Feed: https://www.financemagnates.com/feed/▶️ Telegram: https://t.me/financemagnatesnewsDon’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

The copy trading market is projected to double in size, growing from $2.2 billion to $4 billion by the end of this decade. In light of this, brokers and financial institutions are increasingly adopting PAMM, MAM, and Copy Trading solutions to scale operations and drive profitability. In this insightful webinar, Sergey Ryzhavin, Product Owner at B2COPY, outlines the advanced features of the B2COPY platform, showcasing how it enhances Copy Trading, PAMM, and MAM performance. Sergey also explores strategies for using these tools to attract new clients, improve customer engagement, and create additional revenue streams.📣 Stay updated with the latest in finance and trading! Follow Finance Magnates for news, insights, and event updates across our social media platforms. Connect with us today:🔗 LinkedIn: https://www.linkedin.com/company/financemagnates/👍 Facebook: https://www.facebook.com/financemagnates/📸 Instagram: https://www.instagram.com/financemagnates_official🐦 X (Twitter): https://twitter.com/financemagnates/📡 RSS Feed: https://www.financemagnates.com/feed/▶️ Telegram: https://t.me/financemagnatesnewsDon’t miss out on our latest videos, interviews, and event coverage. 🔔 Subscribe to our YouTube channel for more!🔔

-

Join us at FMLS:24 to connect with global institutional brokers. Secure your spot today! #fmls24

Join us at FMLS:24 to connect with global institutional brokers. Secure your spot today! #fmls24

Join us at FMLS:24 to connect with global institutional brokers. Secure your spot today! #fmls24

Join us at FMLS:24 to connect with global institutional brokers. Secure your spot today! #fmls24

Join us at FMLS:24 to connect with global institutional brokers. Secure your spot today! #fmls24

Join us at FMLS:24 to connect with global institutional brokers. Secure your spot today! #fmls24

-

🌟 Explore cutting-edge solutions and connect with fintech leaders at FMLS:24!

🌟 Explore cutting-edge solutions and connect with fintech leaders at FMLS:24!

🌟 Explore cutting-edge solutions and connect with fintech leaders at FMLS:24!

🌟 Explore cutting-edge solutions and connect with fintech leaders at FMLS:24!

🌟 Explore cutting-edge solutions and connect with fintech leaders at FMLS:24!

🌟 Explore cutting-edge solutions and connect with fintech leaders at FMLS:24!

-

🤝 Meet industry leaders at the premier event for brokers – FMLS:24. Secure your spot today!

🤝 Meet industry leaders at the premier event for brokers – FMLS:24. Secure your spot today!

🤝 Meet industry leaders at the premier event for brokers – FMLS:24. Secure your spot today!

🤝 Meet industry leaders at the premier event for brokers – FMLS:24. Secure your spot today!

🤝 Meet industry leaders at the premier event for brokers – FMLS:24. Secure your spot today!

🤝 Meet industry leaders at the premier event for brokers – FMLS:24. Secure your spot today!