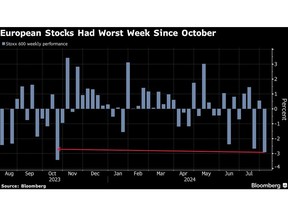

European Stocks Drop Most in Two Years as Global Rout Deepens

Technology tamfitronics

European stocks dropped, sending a regional benchmark to the lowest since February, amid a deepening global retreat sparked by concerns of a US economic slowdown.

Author of the article:

Bloomberg News

Allegra Catelli and Michael Msika

Published Aug 05, 2024 • Last updated 12 minutes ago • 2 minute read

(Bloomberg) — European stocks dropped, sending a regional benchmark to the lowest since February, amid a deepening global retreat sparked by concerns of a US economic slowdown.

The Stoxx Europe 600 Index fell 2.2% by the close in London. The index pared some of its losses after data showed the US services sector expanded in July. All sectors declined, with utilities, real estate and energy shares sinking the most.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.

- Daily content from Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

Technology tamfitronics Sign In or Create an Account

or

Article content

The index had fallen as much as 3.6% during the session, the steepest intraday drop since March 2022. The moves extended last week’s selloff fueled by investor fears around a US recession. France’s CAC Index has now fallen more than 10% from its recent peak, the technical definition of a correction.

“The magnitude of the sell-off has certainly caught people by surprise,” said Richard Saldanha, global equity fund manager at Aviva Investors, adding that the jobs data in the US was certainly not dire. “We expect markets to remain turbulent as people assess what the next moves from central banks will be.”

A weaker-than-expected US job data on Friday reignited recession fears, with traders assuming the Federal Reserve was now behind the curve in cutting rates. Technical factors including lower liquidity during summer months, as well as an extremely elevated stock exposure until July likely played a part in the selloff. In Asia, the MSCI Asia Pacific Index sank 6.3% and now is down 12% from its recent peak on July 11. In another sign of souring investor sentiment globally, Bitcoin slumped about 6%.

Article content

“Positioning was extreme under every systematic fund, and this story was to me unsustainable,” said Alberto Tocchio, portfolio manager at Kairos Partners. The selloff “will create a lot of opportunities. I don’t think there is any bubble on technology or artificial intelligence. Eventually it’s just a matter of trying to not lose too much.”

Among single stocks, L’Oreal SA said it is buying a 10% stake in Swiss skincare company Galderma Group AG to benefit from its range of dermatological products. Both stocks ended the session in the green, outperforming the broader market.

For more on equity markets:

- Bad News Is Bad Again as Recession Risks Resurface: Taking Stock

- M&A Watch Europe: SocGen Sells to UBP; L’Oreal Galderma Stake

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

—With assistance from Sagarika Jaisinghani, Lisa Pham and Michael Hennessey.

Article content

Discover more from Tamfis Nigeria Lmited

Subscribe to get the latest posts sent to your email.

Hot Deals

Hot Deals Shopfinish

Shopfinish Shop

Shop Appliances

Appliances Babies & Kids

Babies & Kids Best Selling

Best Selling Books

Books Consumer Electronics

Consumer Electronics Furniture

Furniture Home & Kitchen

Home & Kitchen Jewelry

Jewelry Luxury & Beauty

Luxury & Beauty Shoes

Shoes Training & Certifications

Training & Certifications Wears & Clothings

Wears & Clothings