Honasa targets Gen Z with cosmetics label Staze

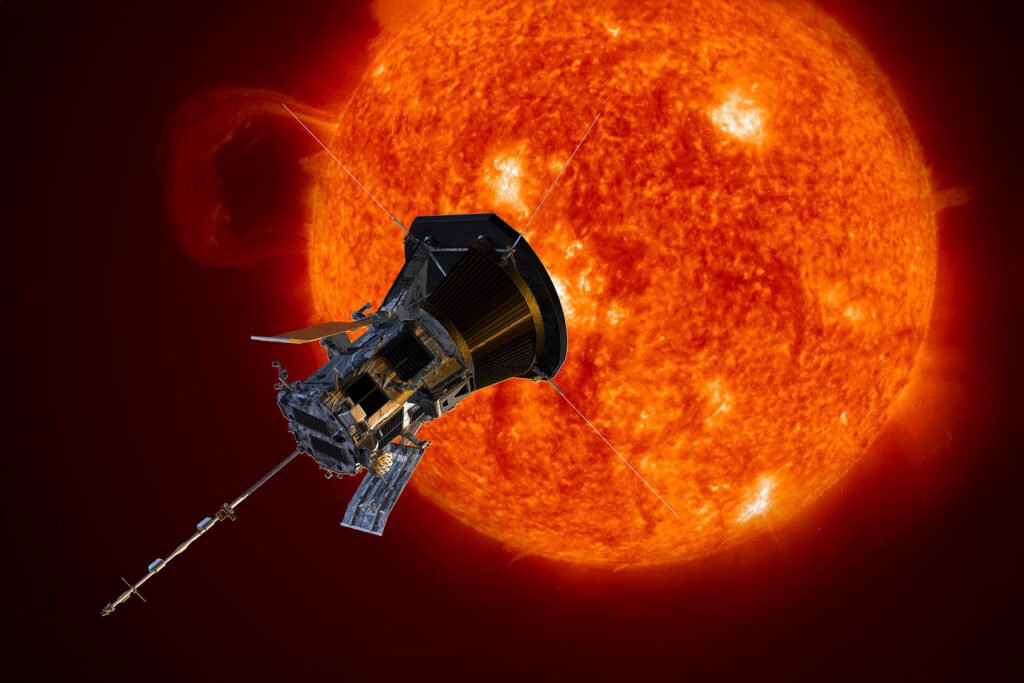

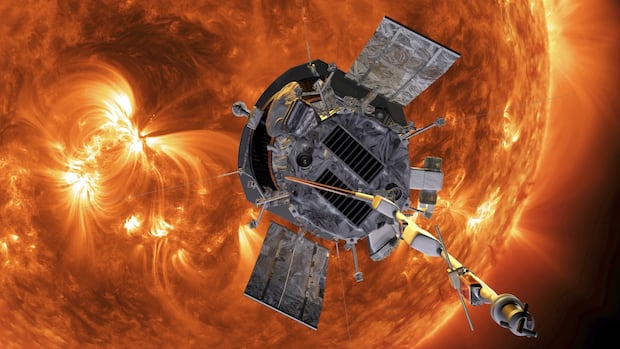

NASA Space Technology

Honasa Particular personthe parent firm of beauty and inner most care (BPC) label Mamaearthhas entered the colour cosmetics dwelling with a fresh label ‘Paths’, centered at 18- to 24-three hundred and sixty five days-olds.

Staze is the seventh label in Honasa Private Person’s portfolio after Mamaearth (its largest), The Derma Co, Aqualogica, Ayuga, Dr Sheth’s and Bblunt.

Elevate Your Tech Prowess with Excessive-Price Capacity Programs

| Offering College | Course | Web jabber |

|---|---|---|

| IIM Kozhikode | IIMK Developed Records Science For Managers | Search the advice of with |

| Indian College of Enterprise | ISB Professional Certificates in Product Administration | Search the advice of with |

| Indian College of Enterprise | ISB Product Administration | Search the advice of with |

The firm will promote merchandise equivalent to lipsticks, kajal pens, foundations, compacts and eyeliners below the fresh label. Staze has eight classes with 40 stock-keeping devices (SKUs).

Honasa Particular person cofounder and CEO Varun Alagh urged ET that the fresh label will compete with the likes of L’oreal-owned cosmetics label Maybelline and Hindustan Unilever’s Lakme on fee parts. Staze will occupy a imply unit fee of Rs 300-350, same to Maybelline and Lakme, he talked about.

Nonetheless, Staze just isn’t any longer Honasa’s first mission into the Rs 15,000-crore colour cosmetics class. The Gurugram-essentially based entirely firm launched merchandise on this class in 2022 below the Mamaearth label, and has scaled it to over Rs 150 crore in annual income bustle fee (ARR). ARR is a forecasting plot that helps predict the financial performance of a firm over a three hundred and sixty five days per previous earnings files.

“Shade cosmetics has been an map of pastime for us because we judge that a immense multiplier for BPC development in the nation can be girls folks joining the personnel. We’re very bullish on how every three hundred and sixty five days thousands and thousands will add to this cohort,” Alagh talked about, at the side of that the best development in the total BPC section is anticipated to return from colour cosmetics and skincare sub-segments.

“We’re already right in skincare. More than 60% of Honasa’s revenues comes from skincare. We started thought the coloration cosmetics dwelling with Mamaearth two years previously. It was important for us to love the class from a user besides to a product R&D point of ogle,” Alagh talked about.

“Because this (Staze) is a Gen Z-oriented label the place we are taking a stumble on on the starting up jobbers or faculty-goers, we felt right here’s the cost point whereby we can carry a buyer into the emblem and the class,” he added.

Market pyramid

In addition to established names equivalent to Maybelline and Lakme, the coloration cosmetics class has considered a slew of fresh-age players attain in over the previous couple of years that are expanding on the support of like a flash-commerce development thru platforms equivalent to Zomato-owned Blinkit, Swiggy Instamart and Zepto.

Below the section whereby Staze merchandise can be priced are producers equivalent to Blue Heaven – backed by non-public equity company Samara Capital – and Reliance Retail-owned Perception.

The class above Staze – with merchandise at a imply unit fee of over Rs 400 – entails the likes of MamaearthA91 Partners-backed Sugar Cosmetics and Colorbar Cosmetics.

Whereas Sugar Cosmetics reported an working income of Rs 420 crore in FY23, Blue Heaven posted Rs 259 crore in topline.

“The Indian BPC market is someplace spherical $25-30 billion, of which 10-12% is on-line. On-line is rising at a sooner dart. The scale of the low-fee beauty market just isn’t any longer known but one can assess that merchandise below the reasonable selling fee of Rs 200 may be contributing shut to 40-50% of the total market,” talked about Karan Taurani, senior vp at brokerage company Elara Capital.

The section is rising at a rapidly dart thanks to ease of distribution from on-line channels and potentialities an increasing number of willing to take a look at out fresh merchandise, he added.

Nonetheless, in its earning presentation for the October-December quarter, Honasa talked about it estimates the masstige section – comprising mass produced goods positioned as prestigious merchandise – to develop at double the dart of mass merchandise.

Honasa’s class expansion

Even as Honasa’s dwelling of producers continues to develop, sector consultants estimate the event from existing producers to taper off over the arriving years, making it imperative for the firm to enter newer producers and classes.

“The ramp-up in development is anticipated to be led by the youthful producers in the portfolio now, but as these producers turn out to be smartly established…some section of development will reasonable. Launching fresh producers and classes if that’s the case will turn out to be key to the firm’s development myth,” a Mumbai-essentially based entirely user sector equity analyst urged ET.

After Mamaearth, the firm’s most spellbinding producers are The Derma Co and Aqualogica, which occupy crossed ARR of Rs 350 crore and Rs 150 crore, respectively.

Earlier this month, Honasa announced its entry into the moisturising soaps class, competing with the likes of THEIR’s Dove, which is a Rs 2,000-crore label.

Hot Deals

Hot Deals Shopfinish

Shopfinish Shop

Shop Appliances

Appliances Babies & Kids

Babies & Kids Best Selling

Best Selling Books

Books Consumer Electronics

Consumer Electronics Furniture

Furniture Home & Kitchen

Home & Kitchen Jewelry

Jewelry Luxury & Beauty

Luxury & Beauty Shoes

Shoes Training & Certifications

Training & Certifications Wears & Clothings

Wears & Clothings