VCs happy with returns as early backers offload 10% stake in Honasa Consumer: Varun Alagh

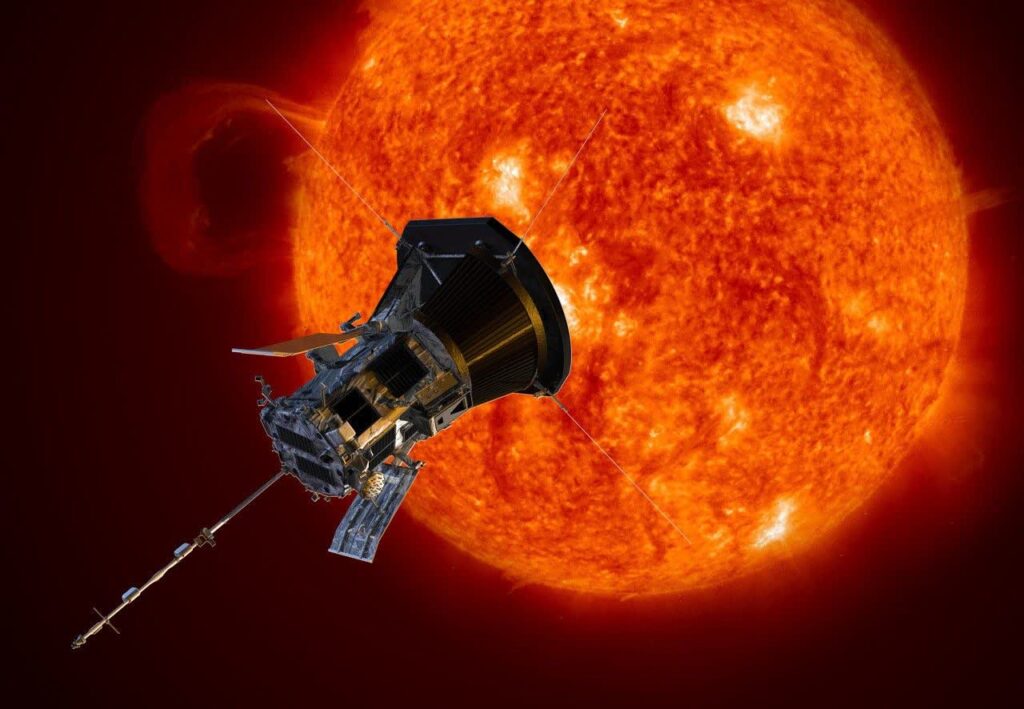

NASA Space Technology

NASA Space Technology According to the bulk deal data available on the National Stock Exchange (NSE), Peak XV Partners sold a 3.81% stake in Honasa Consumer and Fireside Ventures offloaded a 2.03% stake in the company.

By CNBCTV18September 16, 2024, 12:05:00 AM IST (Published)

By CNBCTV18September 16, 2024, 12:05:00 AM IST (Published)

Varun Alagh, the founder of Honasa Consumer, told CNBC-TV18 in an exclusive chat that all their investors are very happy with the returns they have generated after shares worth ₹1,763 crore changed hands in the block deal on Thursday. “After you go public, it’s great because you have unlocked value for your investors,” added Alagh.

Mamaearth’s early backers including Peak XV Partners, Fireside Ventures, Sofina and Stellaris Venture Partners have sold a 10% stake in the D2C company’s parent Honasa Consumer on September 12.

“The most amazing thing in this block deal has been the quality of investors who are actually buying the stock now. ₹1,800 crores worth of block deal means ₹1,800 crores worth of incremental capital has come into buying the stock,” Varun Alagh told CNBC-TV18.

“Whoever bought the stock believes the company will go from here to tremendous heights and we are very happy with the trust that’s shown and will continue to deliver on that,” the founder added.

According to the bulk deal data available on the National Stock Exchange (NSE), Peak XV Partners sold a 3.81% stake in Honasa Consumer and Fireside Ventures offloaded a 2.03% stake in the company.

Sofina Ventures SA divested 60.15 lakh shares or 1.85% stake, Stellaris Venture Partners sold 45.30 lakh shares, representing a 1.4% stake in Honasa Consumer and Sequoia Capital Global Growth Fund III-US/India Annex Fund disposed of 28.71 lakh shares or 0.88% stake in the company.

Peak XV acquired a stake in Mamaearth in early 2020 and at the end of the quarter ended June 2024, Peak XV Partners held an 18.69% stake in Honasa Consumer. Meanwhile Sequoia Capital held a 4.35% stake and Fireside Ventures had a 4.28% stake in the company at the end of the quarter ended June 2024. Sofina Ventures owned 5.16% and Stellaris Ventures held a 4.75% stake in Honasa Consumer.

After the share sale, Peak XV Partners’ stakeholding in Honasa Consumer has come down to 14.88%, Fireside Ventures to 2.25% and Sofina to 3.31% stake.

The partial exits come after Honasa Consumer, which owns and operates Mamaearth, reported a 63% year-on-year growth in its consolidated net profit at ₹40 crore for the quarter ended June. The same was ₹25 crore a year ago.

Meanwhile, ICICI Prudential Life Insurance acquired 28.78 lakh shares or 0.88% stake in Honasa Consumer and Morgan Stanley Asia Singapore purchased 24.17 lakh shares of the company. The shares were bought at an average price of ₹495 apiece, taking the combined deal value to ₹262.17 crore.

Discover more from Tamfis Nigeria Lmited

Subscribe to get the latest posts sent to your email.

Hot Deals

Hot Deals Shopfinish

Shopfinish Shop

Shop Appliances

Appliances Babies & Kids

Babies & Kids Best Selling

Best Selling Books

Books Consumer Electronics

Consumer Electronics Furniture

Furniture Home & Kitchen

Home & Kitchen Jewelry

Jewelry Luxury & Beauty

Luxury & Beauty Shoes

Shoes Training & Certifications

Training & Certifications Wears & Clothings

Wears & Clothings