Ethereum: Brief bother or long-term good points for ETH holders

Top Stories Tamfitronics

![]()

Journalist

- Ethereum’s tag fell while community exclaim and bustle plummeted

- On a macro level, Ethereum’s community continues to explore exclaim

Ethereum [ETH] recorded an enormous decline in tag over the previous 24 hours, alongside with the the rest of the cryptocurrency market. At press time, ETH used to be trading at $3,267.60, with its price down by 7.22% on the charts.

Ethereum takes a hit

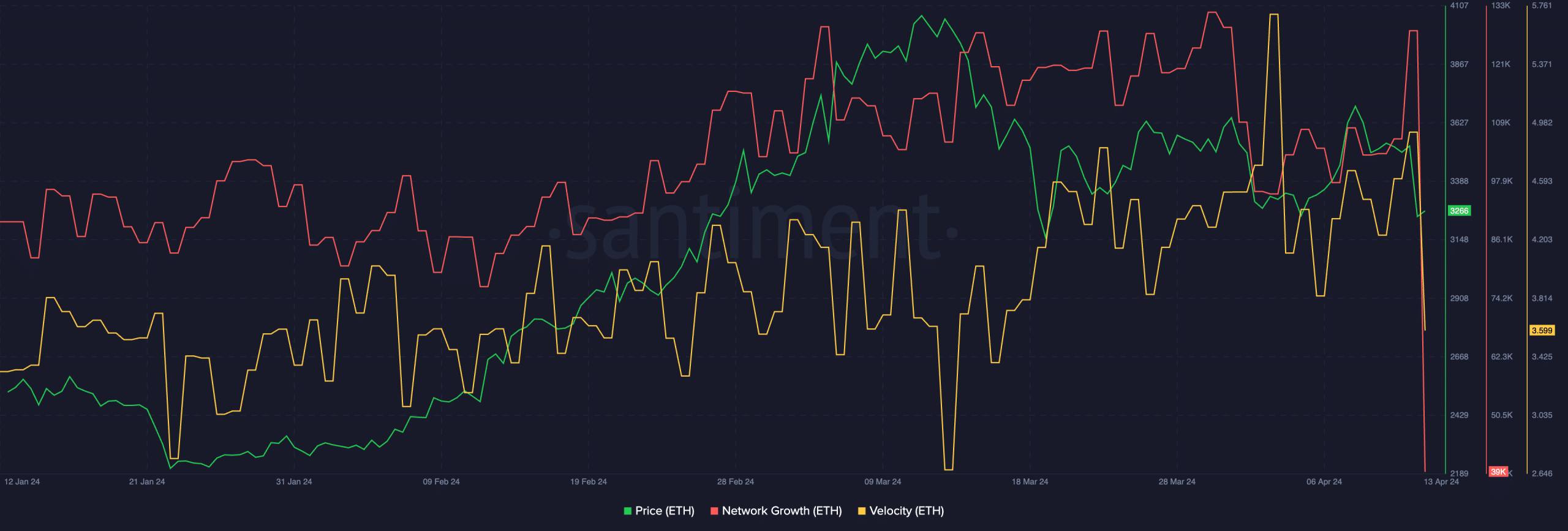

Over this length, the community exclaim for Ethereum declined tremendously. This indicated that unique customers had been losing ardour in ETH and the series of unique addresses appealing to aquire ETH at this fee used to be very low. Moreover, the fee for ETH also fell, suggesting that the frequency with which ETH used to be being traded had declined.

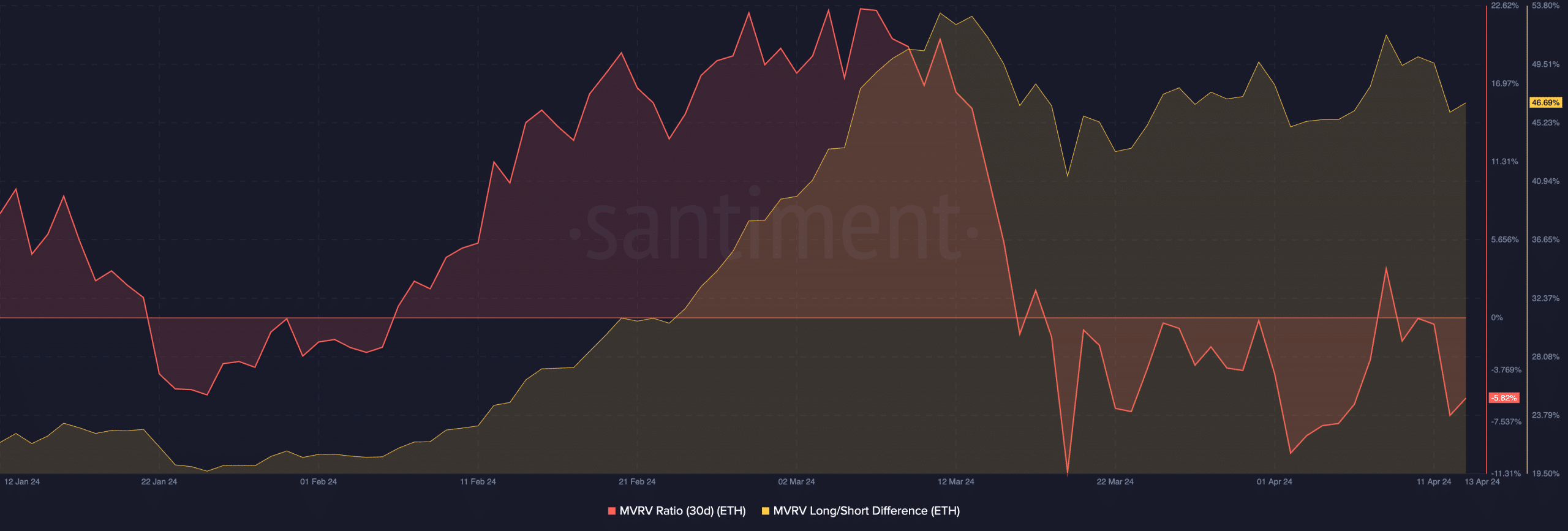

Moreover, Ethereum’s MVRV ratio fell, indicating that the series of addresses that had been a hit had fallen. Prolonged/Rapid incompatibility for ETH hiked as properly, indicating that the series of long dash holders of ETH had elevated.

Taking a explore at the elevated image

Even though within the rapid term it appears like ETH is struggling, the sizable image is far extra promising. Genuinely, it will also additionally be seen that Ethereum’s community has reach a long reach since final year.

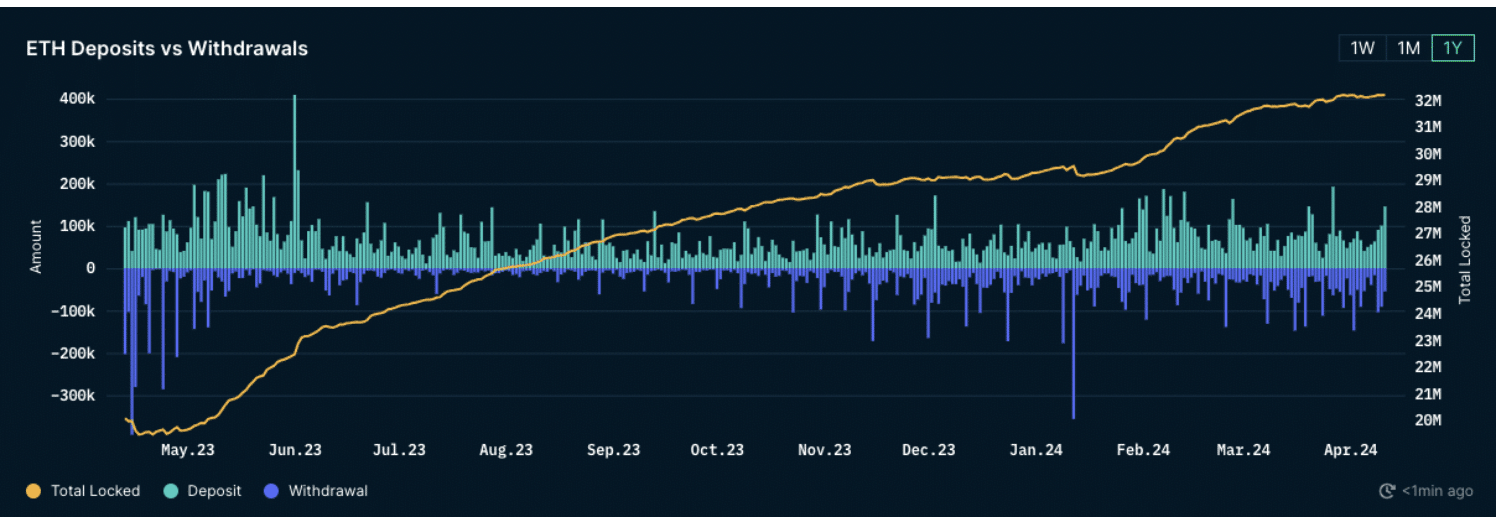

Shall we embrace – Staked Ether has seen vital exclaim over the previous year, in accordance with Nansen recordsdata, surging from 20 million to 32.2 million ETH. No matter a minor dip in staked ETH because of the withdrawals from centralized exchanges following the roll-out of Shapella, there used to be a noteworthy 61% surge in staked ETH.

This represents a staggering $42 billion inflow into Ethereum’s staking infrastructure, per latest pricing.

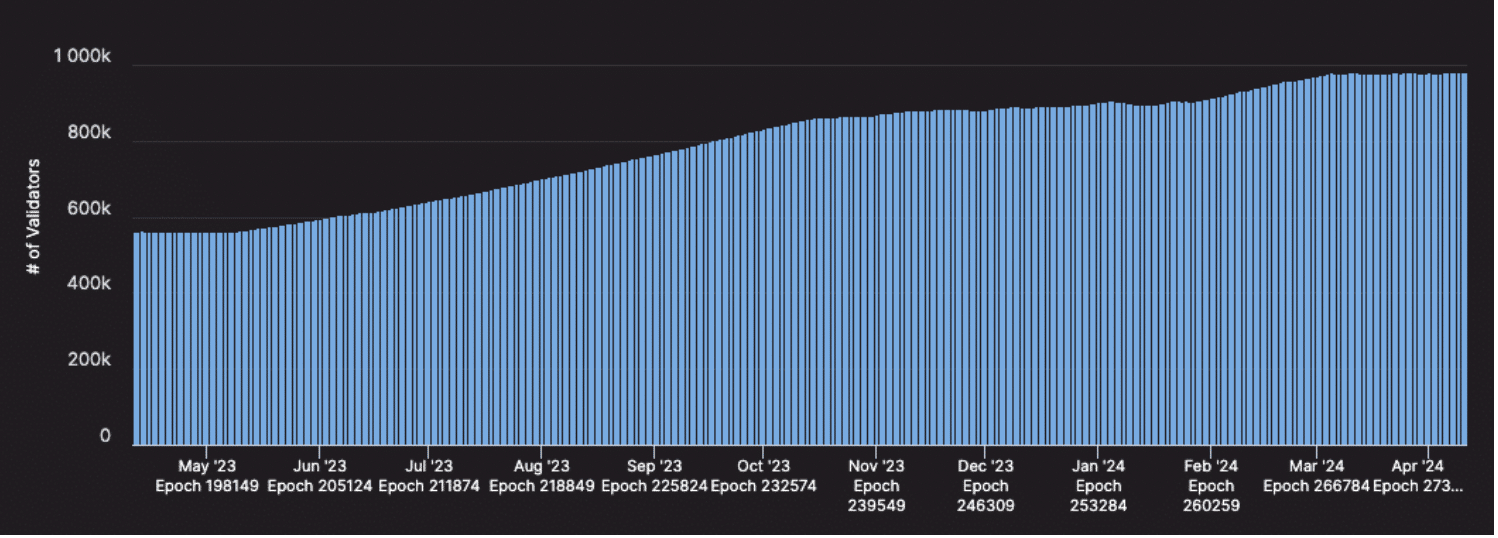

Validator numbers acquire also seen vital exclaim since Shapella, assuaging concerns internal the Ethereum neighborhood a couple of doable mass exodus of validators. In accordance to Austin Blackerby, EVM Analytics Supervisor at Flipside Crypto, this exclaim has eased many fears.

This time final year, there had been practically 563,000 validators securing Ethereum. Since then, this resolve has surged by over 74% to approximately 981,000 validators.

Sustained exclaim in validators has raised extra concerns among protocol builders and researchers, as outlined in a September 2023 chronicle. An infinite validator space dimension lines explore-to-explore networking and messaging, potentially inflicting node disasters because of the high computational load and bandwidth requirements.

ReadEthereum’s [ETH] Label Prediction2024-25

Moreover, a sizeable validator space makes future upgrades tougher and riskier to achieve. The upcoming upgrade, “Electra,” is anticipated to take care of the challenges posed by the increasing validator space.

Simply set, the area’s largest altcoin’s long-term future looks extra stable and promising than its short.

Discover more from Tamfis

Subscribe to get the latest posts sent to your email.