Politics tamfitronics

Oil steadied after the finest produce in a week, with OPEC+ role to verify its policy of producing cuts amid tensions within the Middle East and Russia.

Author of the article:

Bloomberg Files

Yongchang Chin

Printed Mar 25, 2024 • Last updated 1 hour within the past • 2 minute read

![Oil Holds Approach With OPEC+ Cutbacks and Geopolitics in Level of curiosity 3 Politics tamfitronics rbgz[75v4{24o}us]ei]wa3}_media_dl_1.png](https://smartcdn.gprod.postmedia.digital/financialpost/wp-content/uploads/2024/03/oils-impending-golden-cross-brent-50-day-moving-average-to-.jpg?quality=90&strip=all&w=288&h=216&sig=73RZ1NOwOPvaGUakyFxsqw)

(Bloomberg) — Oil steadied after the finest produce in a week, with OPEC+ role to verify its policy of producing cuts amid tensions within the Middle East and Russia.

World benchmark Brent traded below $87 a barrel after rising 1.6% on Monday, while West Texas Intermediate turned into near $82. OPEC+ delegates aren’t seeing a hang to alternate supply policy at a evaluate meeting next week, in step with several national officers, with quotas in subject unless June proving effective. The Houthis renewed threats in opposition to Saudi Arabia if it supported US strikes.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the most up-to-date data for your metropolis and one day of Canada.

- Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.

- Everyday express from Monetary Occasions, the arena’s main global industry publication.

- Limitless on-line gain admission to to read articles from Monetary Submit, National Submit and 15 data websites one day of Canada with one account.

- National Submit ePaper, an digital duplicate of the print edition to see on any system, fragment and touch upon.

- Everyday puzzles, along with the Original York Occasions Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the most up-to-date data for your metropolis and one day of Canada.

- Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.

- Everyday express from Monetary Occasions, the arena’s main global industry publication.

- Limitless on-line gain admission to to read articles from Monetary Submit, National Submit and 15 data websites one day of Canada with one account.

- National Submit ePaper, an digital duplicate of the print edition to see on any system, fragment and touch upon.

- Everyday puzzles, along with the Original York Occasions Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Construct an account or mark in to continue along with your reading trip.

- Get entry to articles from one day of Canada with one account.

- Portion your strategies and be a part of the dialog within the feedback.

- Have the good thing about extra articles monthly.

- Get electronic mail updates from your well-liked authors.

Politics tamfitronics Designate In or Construct an Memoir

or

Article express

Article express

Uncouth has risen nearly 13% to date this quarter after breaking out of a factual vary that it turned into in for the first couple of months. Assaults by Ukraine on Russian refineries hang aided positive aspects, along with indicators of strength in some product markets along with gasoline. The certain overall market outlook has spurred hedge funds to make bigger their bullish bets on Brent.

In India, meanwhile, investors of Venezuelan oil hang halted purchases from the OPEC producer earlier than the expiry of a sanctions waiver within the center of next month. That comes after the South Asian nation stopped accepting incorrect on tankers owned by Russia’s inform-bustle Sovcomflot PJSC amid sanctions dangers.

Signs of a shift in monetary policy hang also aided sentiment. The Federal Reserve has signaled a willingness to lower pastime charges later this one year, buoying appetite for threat sources along with oil. Uncouth futures were monitoring equity benchmarks in fresh sessions.

“The dangers of supply disruptions persist,” said Yeap Jun Rong, a market strategist at IG Asia Pte in Singapore, citing the Russia-Ukraine battle as extra refiners are hit. Weakness within the US buck to date this week has also been supportive, he said.

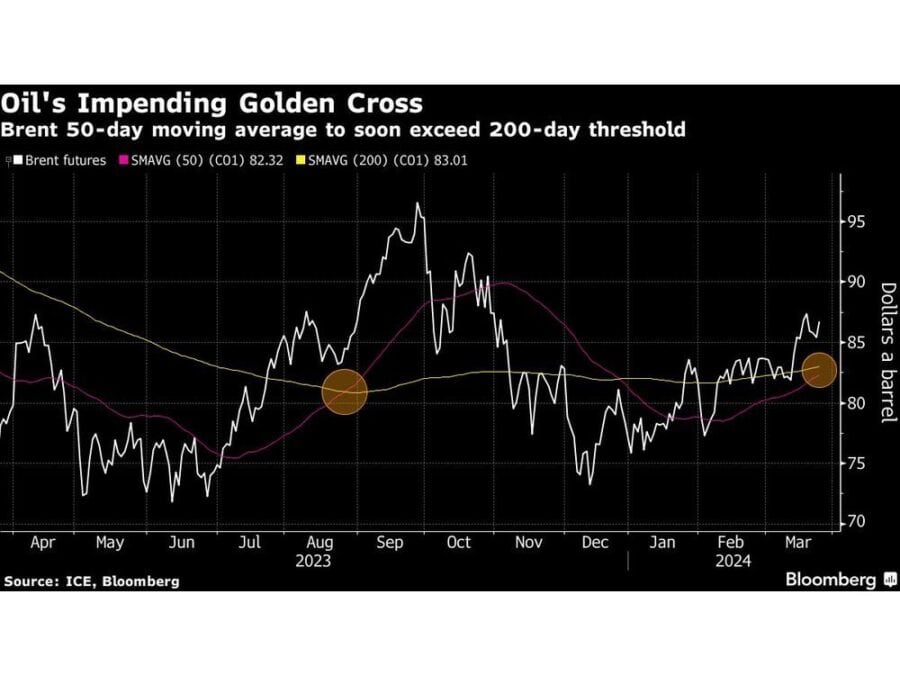

The technical backdrop is certain, too, with Brent’s transferring averages near forming a golden sinful, a bullish sample. That’s when an asset’s 50-day transferring common exceeds the corresponding 200-day figure. Its final formation for the generic contract in August preceded Brent surging by higher than $10 a barrel to above $95.

To gain Bloomberg’s Energy Everyday e-newsletter into your inbox, click on here.

Article express