More challenging project fin concepts hit PSU infra NBFC shares

Business new tamfitronics

Mumbai:

RBI

‘s proposal to tighten

lending requirements

for

project financing

by banks and

NBFCs

weighed on investor sentiment as they offered

PSU shares

esteem PFC, REC and Ireda on Monday, flattening costs by as worthy as 12% intraday.

Brokerages CLSA and IIFL, then as soon as more, assured traders that the affect of the proposals, even supposing made into concepts, could per chance also simply now not be worthy on the profitability of project financiers.

It could perhaps perhaps per chance then as soon as more in fact useful them to enjoy up their capital to meet regulatory requirements.

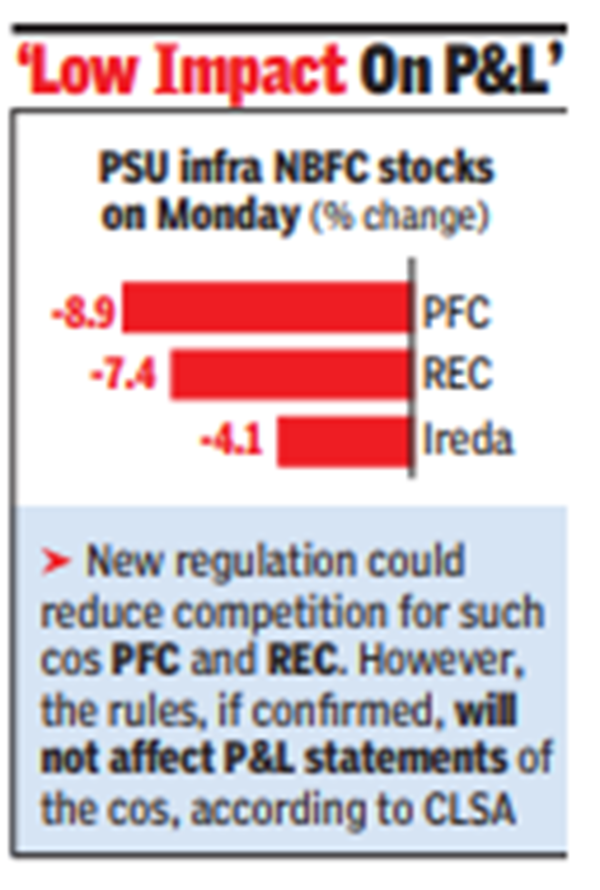

On Monday, after dipping sharply in opening trades, PFC closed 8.9% down at Rs 438, REC closed 7.4% down at Rs 517 and Ireda closed 4.1% down at Rs 172.

In accordance with a file by IIFL, infra-focused NBFCs esteem REC, PFC and Ireda can look a capacity hit of 200-300 basis facets (100 basis facets=1 share point) to their capital ratio. “Valuation of these NBFCs can additionally be potentially impacted,” the file stated.

Bankers snort that RBI’s proposal to impose a 5% provision requirement on project loans could perhaps had been ended in by the expected credit rating loss (ECL) norms, which require banks to accomplish provisions in step with previous abilities of default. ECL norms are prudential guidelines in step with global most attention-grabbing practices.

“At any time when ECL norms are notified, banks will wish to connect of abode aside provisions for defaults in step with their abilities, which intention it can perhaps per chance be over 5%,” stated a banker.

Hot Deals

Hot Deals Shopfinish

Shopfinish Shop

Shop Appliances

Appliances Babies & Kids

Babies & Kids Best Selling

Best Selling Books

Books Consumer Electronics

Consumer Electronics Furniture

Furniture Home & Kitchen

Home & Kitchen Jewelry

Jewelry Luxury & Beauty

Luxury & Beauty Shoes

Shoes Training & Certifications

Training & Certifications Wears & Clothings

Wears & Clothings