Markets Weigh Up Possibility of Retaliation-Cycle After Iran Hits Israel

Politics tamfitronics

Financial markets will face the new week fretting about geopolitics with grand riding on whether or not Iran’s unheard of weekend strike on Israel triggers rounds of retaliation.

Author of the article:

Bloomberg Files

Srinivasan Sivabalan, Ye Xie and Thyagaraju Adinarayan

Printed Apr 14, 2024 • Final updated 1 hour ago • 5 minute learn

(Bloomberg) — Financial markets will face the new week fretting about geopolitics with grand riding on whether or not Iran’s unheard of weekend strike on Israel triggers rounds of retaliation.

With merchants already rattled by sticky inflation and the likelihood of elevated-for-longer passion charges, the escalation of the Center East crisis is determined to inject new volatility when procuring and selling resumes.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to learn the most modern news to your metropolis and across Canada.

- Queer articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.

- Day-to-day squawk material from Financial Times, the area’s main world industry newsletter.

- Limitless on-line entry to learn articles from Financial Put up, National Put up and 15 news websites across Canada with one legend.

- National Put up ePaper, an electronic replica of the print version to gape on any method, part and snarl on.

- Day-to-day puzzles, including the Fresh York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to learn the most modern news to your metropolis and across Canada.

- Queer articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.

- Day-to-day squawk material from Financial Times, the area’s main world industry newsletter.

- Limitless on-line entry to learn articles from Financial Put up, National Put up and 15 news websites across Canada with one legend.

- National Put up ePaper, an electronic replica of the print version to gape on any method, part and snarl on.

- Day-to-day puzzles, including the Fresh York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Make an legend or register to proceed with your reading journey.

- Earn admission to articles from across Canada with one legend.

- Half your thoughts and join the conversation in the feedback.

- Trip additional articles month-to-month.

- Earn electronic mail updates out of your favourite authors.

Politics tamfitronics Signal In or Make an Fable

or

Article squawk material

Article squawk material

When Hamas attacked Israel in October, the largest apprehension for heaps of market contributors modified into as soon as that Iran would finally be drawn into the combating. Now because the battle widens, many instruct oil could well furthermore surpass $100 a barrel and request a flight to Treasuries, gold and the dollar, along with additional stock-market losses.

A spike in nerves have to unexcited unexcited be tempered by the flight to security in markets on Friday in anticipation of a strike, Iran’s assertion that “the matter could well furthermore honest also be deemed concluded” and a document that President Joe Biden told Israeli Prime Minister Benjamin Netanyahu that the US acquired’t enhance an Israeli counterattack in opposition to Iran.

“Merchants’ natural response is to watch safe-haven assets in moments love this,” talked about Patrick Armstrong, chief investment officer at Plurimi Wealth LLP. “Reactions will be considerably dependent on Israel’s response. If Israel would not escalate from right here, it can probably furthermore honest present a likelihood to buy risk assets at lower costs.”

Possibility-Addicted Wall Street Funds Are Shaken as Despicable Files Piles Up

Bitcoin gave an early perception into market sentiment. The token sank nearly 9% in the wake of the assaults on Saturday, completely to rebound on Sunday and substitute shut to the $64,000 impress.

By signing up you consent to receive the above newsletter from Postmedia Community Inc.

Article squawk material

Article squawk material

Shares markets in Saudi Arabia and Qatar posted modest losses below skinny procuring and selling volumes. Israel’s equity benchmark fluctuated between features and losses no lower than nine cases forward of closing with a diminutive function.

“Center Japanese markets opened with relative unexcited following Iran’s assault, which modified into as soon as perceived as a measured retaliation, rather then an try at escalation,” talked about Emre Akcakmak, a senior consultant at East Capital in Dubai. “Nonetheless, the market affect could well extend past the Center East for that reason of secondary results on oil and energy costs, potentially influencing the area inflation outlook.”

Merchants will now weigh the risk of a strike and counter-strike cycle, with many having a scrutinize to grease as a manual for the methodology to answer. Brent uncouth is already up nearly 20% this year and procuring and selling north of $90 a barrel.

While the battle in the Center East hasn’t yet had any affect on production, Red Sea assaults by Iran-backed Houthis in the Red Sea enjoy disrupted transport. Merchants largely apprehension a widening battle could well furthermore disrupt tanker shipments from the Persian Gulf thru the Strait of Hormuz.

Article squawk material

Israel’s Warfare Cupboard Discusses Response to Iran Strikes: TOPLive

Worries about turmoil in the direct enjoy furthermore been filtering thru world markets. The S&P 500 is coming off its largest weekly decline since October on the aid of elevated-than-anticipated inflation and disappointing financial institution earnings.

Within the bond market, merchants will be weighing the risk that more costly energy bills could well furthermore honest add to swirling inflation fears. While Treasuries are inclined to profit in cases of uncertainty, the specter of passion charges staying high could well furthermore limit moves. US equity and bond futures will delivery at 6 p.m. Fresh York time Sunday.

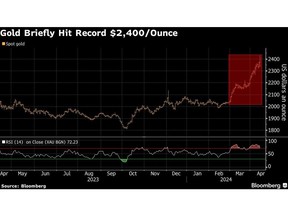

Within the meantime, gold has been on a plug, gaining 13% this year to hit a document above $2,400 an ounce. Merchants enjoy furthermore sought the soundness of the US dollar. An index of the currency rose 1.3% last week, the splendid efficiency since leisurely 2022.

Here’s what merchants and analysts are asserting:

Erik Meyersson, chief rising markets strategist at SEB:

“Our oil analysts attain not gape grand trace of a geopolitical risk top rate in oil costs to this level. We request this to reflect market perceptions of low risks of escalation up until now. This equilibrium is seemingly to be examined if Iran and Israel proceed to assault every other.”

Article squawk material

Gonzalo Lardies, senior equities fund supervisor at Andbank:

“A new atmosphere of uncertainty is now opening up, nevertheless the market on Friday already partly priced on this downside, so if it would not irritate the affect have to unexcited not be very high. The likelihood is if this downside escalates and there could be contagion in the direct.”

Alfonso Benito, chief investment officer at Dunas Capital:

“I wouldn’t request intriguing drops given how Israel has defended its air defend. We must always unexcited gape protection corporations up, oil up and gas up, whereas airlines could well furthermore decline. Bonds will upward push, nevertheless I don’t judge excessively. Merchants could well furthermore make essentially the most to partly dazzling the increases of most modern months.”

Joachim Klement, a strategist at Liberum:

“The response will very grand count on the response of Israel these days and whether or not the US can manage to restrain Benjamin Netanyahu.”

“Within the next couple of days, stock markets will center of attention on the geopolitical downside, rather then central financial institution circulate or the catch economy in the US. Hence, we request the rally to stall until there could be more clarity if the downside in Iran-Israel calms down. If we cease up in a shooting battle between Israel and Iran, then the rally will be stalled for longer.”

Article squawk material

Mark Matthews, strategist at Bank Julius Baer in Singapore:

“The accurate thing is that Iran did warn in regards to the assault effectively beforehand. Militia analysts instruct it modified into as soon as performed in a technique that minimized casualties. I don’t gape why it would trigger Fed rate expectations to tumble more or it would trigger the oil designate to pass up loads. Iran is making an try to defuse this and so is the US. The foremost is what Israel’s respond will be, and then Iran’s respond to that. If Israel does a de-escalatory strike, and then the Iranians attain an very honest correct more de-escalatory strike, then it would be over with.”

Geoff Yu, senior strategist for EMEA Markets at BNY Mellon in London:

“There could be scope for additional accumulation of bucks, even with most modern searching for out after the CPI recordsdata. Our customers dwell overweight the euro, Canadian dollar and a few high-lift currencies such because the Mexican peso, so right here’s the place we would scrutinize for rotation in the buck’s desire.”

Neil Shearing, chief economist at Capital Economics in London:

“Our sense is that occasions in the Center East will add to the explanations for the Fed to undertake a more cautious come to rate cuts, nevertheless they acquired’t prevent it from slicing altogether. We request the foremost pass in September. And assuming that the energy costs don’t spiral over the next month or so, we judge that both the ECB and BOE will lower in June.”

—With the encourage of Macarena Muñoz, Allegra Catelli, Alice Gledhill and Anthony Di Paola.

(Updates costs all the method thru, provides quote.)

Article squawk material

Discover more from Tamfis Nigeria Lmited

Subscribe to get the latest posts sent to your email.

Hot Deals

Hot Deals Shopfinish

Shopfinish Shop

Shop Appliances

Appliances Babies & Kids

Babies & Kids Best Selling

Best Selling Books

Books Consumer Electronics

Consumer Electronics Furniture

Furniture Home & Kitchen

Home & Kitchen Jewelry

Jewelry Luxury & Beauty

Luxury & Beauty Shoes

Shoes Training & Certifications

Training & Certifications Wears & Clothings

Wears & Clothings